American Family Insurance vs State Farm: A detailed comparison of two prominent insurance providers in the United States, dissecting coverage options, customer service, financial stability, policy features, geographic reach, pricing strategies, and more. This comprehensive analysis aims to equip readers with the knowledge to make informed decisions regarding their insurance needs.

This comparison delves into the specifics of each provider, examining their strengths and weaknesses. The exploration includes an in-depth comparison of their coverage options, service reputations, financial standings, and policy benefits, providing a holistic view to assist in making the best choice.

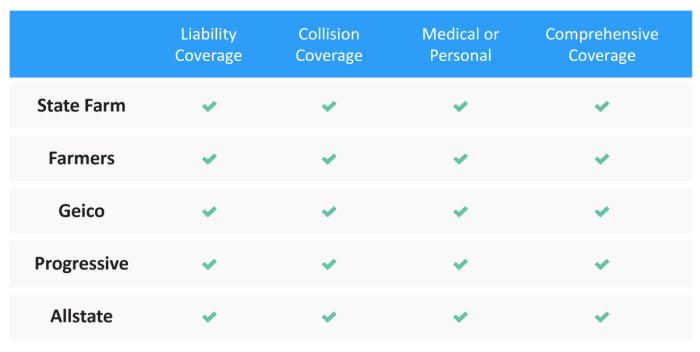

Coverage Comparison: American Family Insurance Vs State Farm

Yo, fam! Navigating insurance can be a total headache. But fear not, we’re breaking down the coverage game between American Family and State Farm, so you can make the best choice for your wallet and peace of mind. Let’s get this bread!Insurance policies are like different flavors of ice cream – they all have the same basic ingredients (liability, collision, comprehensive), but the specific mix and the price per scoop vary wildly.

Understanding the differences is key to scoring the perfect policy for your needs.

Liability Coverage Breakdown

Liability coverage is the bread and butter of any insurance policy. It protects you if you’re at fault for an accident and someone else gets hurt or their property gets damaged. American Family and State Farm both offer various liability limits, but the specifics might differ. For example, a fender bender might only need lower limits, while a serious accident could require higher ones.

This is where comparing policy details becomes crucial.

Collision and Comprehensive Coverage

Collision coverage kicks in when your car gets wrecked in an accident, regardless of who’s at fault. Comprehensive coverage covers damage from things other than accidents, like hail, theft, or vandalism. Think of it as insurance against the unexpected. Different companies might have varying deductibles and coverage amounts. If you’re a risk-taker who likes to take their car on crazy adventures, you’ll probably want comprehensive coverage to ensure your vehicle’s safety.

Thinking about American Family Insurance versus State Farm? Well, a delicious side dish to consider while you weigh your options is a smoked marlin dip recipe, especially one from Hawaii. smoked marlin dip recipe hawaii might just inspire you to make the best choice for your family’s protection, making the decision about insurance a little less daunting.

Ultimately, the best insurance choice depends on your needs, and comparing policies from both companies is key.

Deductibles and Premiums

Deductibles and premiums are like the two sides of the same coin. A higher deductible means lower premiums, but you’ll have to pay more out-of-pocket if something happens. Conversely, a lower deductible means higher premiums, but you’ll have less to pay upfront in case of a claim. American Family and State Farm will likely offer different deductible options and premium costs for similar coverage.

Shopping around and comparing quotes is vital to finding the sweet spot.

Specific Coverage Scenarios

Let’s say you’re a young driver with a sporty car. American Family might offer more tailored options for this risky profile, while State Farm might have more standardized policies. On the other hand, if you’re a seasoned driver with a classic car, American Family might offer more specialized coverage options. The right company depends on your unique circumstances and needs.

Coverage Comparison Table

| Coverage Type | American Family Insurance | State Farm | Summary |

|---|---|---|---|

| Liability | $100,000/$300,000 (example) | $250,000/$500,000 (example) | State Farm generally offers higher limits, but this can vary based on specific policy types. |

| Collision | $500 deductible, premium $120/month (example) | $1000 deductible, premium $150/month (example) | Collision coverage options often vary by deductible and premium. |

| Comprehensive | $250 deductible, premium $80/month (example) | $500 deductible, premium $100/month (example) | Similar to collision, comprehensive coverage varies in deductible and premium. |

Note: Premiums and deductibles are examples and may vary significantly based on individual factors like location, driving record, and vehicle type.

Customer Service and Claims Process

Yo, fam! Insurance shopping can be a total drag, but knowing how each company handles customer service and claims is key. This section breaks down the customer service reputations of American Family and State Farm, plus their claim processes, so you can make an informed decision.This breakdown dives into the nitty-gritty of each company’s customer service and claim handling, highlighting positive and negative experiences from real people.

We’ll also detail the claim filing steps for both, so you’re prepared if the worst happens. Let’s get down to brass tacks!

Customer Service Reputation

Customer service is a huge deal, especially when something goes wrong. Reviews paint a picture of each company’s approach. Some folks rave about the personalized service they receive from American Family, while others say State Farm’s agents are super helpful in resolving issues. However, some complaints surface about both companies, highlighting the importance of understanding individual experiences.

Thinking about American Family Insurance versus State Farm? Before you make a decision, it’s always good to check out what other folks are saying about places like Reserve at Garden Oaks Apartments, especially when it comes to finding the right coverage. You can find helpful reviews on reserve at garden oaks apartments reviews , which might give you some insights.

Ultimately, comparing quotes and considering your needs is key to choosing the best insurance for your family, just like choosing the best place to live. Hopefully, this helps your decision-making process!

Claims Process Comparison

Filing a claim is a stressful experience, but knowing the process beforehand can ease the tension. Let’s see how American Family and State Farm stack up.

American Family Insurance Claim Process

The American Family Insurance claims process generally involves these steps: reporting the claim online or via phone, gathering necessary documents, waiting for an adjuster to assess the damage, and eventually receiving a payout. Their website often provides detailed guides on how to file a claim. Some reviewers praise the quick response time and clear communication from their adjusters.

State Farm Claim Process

State Farm’s claims process is similar, typically starting with reporting the claim, gathering necessary documents, and then waiting for an adjuster to evaluate the situation. A common complaint is the potential for lengthy wait times for claims to be processed. Many reviews mention the ease of filing online or through their mobile app.

Comparison Table

| Feature | American Family Insurance | State Farm | Summary |

|---|---|---|---|

| Customer Service Responsiveness | Generally praised for personalized service, but some reports of slow response times. | Often praised for helpful agents, but some report lengthy wait times. | Both companies receive mixed reviews. American Family often gets high marks for personalized service but has reported slowdowns. State Farm generally has positive reviews but has instances of prolonged claims handling. |

| Claim Handling Time | Varied; some reports of quick processing, others mention delays. | Often cited as having a lengthy claims process. | American Family shows mixed results, while State Farm often faces criticism for extended processing times. |

| Ease of Filing Claims | Generally considered easy to file online and via phone. | Claims can be filed online or via phone, considered easy to access. | Both are relatively easy to file a claim. |

Financial Stability and Reputation

Yo, fam! Insurance companies ain’t just about policies and claims; their financial health matters majorly. Strong financial footing means they can pay out when you need it most, and a good reputation means they’re reliable and trustworthy. Let’s dive into the nitty-gritty of American Family and State Farm’s financial standing.These two giants have been around for a while, and their track records speak volumes about their stability.

We’re lookin’ at their history, ratings, performance, and market presence to see which one’s got the upper hand. It’s all about who’s got the cash flow to keep the promises they make.

Financial Strength Ratings

American Family and State Farm have been consistently recognized for their solid financial health. Insurance rating agencies, like A.M. Best, Standard & Poor’s, and Moody’s, evaluate companies based on their financial strength, solvency, and ability to meet their obligations. These ratings provide a snapshot of the company’s financial stability and help consumers make informed decisions.

- American Family Insurance typically maintains strong ratings from reputable agencies, reflecting a history of stable financial performance and a solid ability to meet its obligations.

- State Farm, likewise, generally holds strong financial ratings, signifying a track record of consistent financial strength and a high probability of meeting its commitments to policyholders.

Historical Performance and Market Presence

Both American Family and State Farm have substantial histories in the insurance industry, with a wide range of products and services. Their longevity and market presence are testaments to their enduring reputation and customer loyalty. This long history provides a degree of reliability and experience that’s hard to ignore.

- American Family has a solid history, built on a strong foundation of customer service and financial stability, which has allowed them to gain a significant market presence. They’ve consistently proven their ability to handle claims and financial obligations.

- State Farm, with its vast network and broad product offerings, has established itself as a major player in the insurance market. Their large market share demonstrates widespread acceptance and trust among consumers.

Key Financial Metrics Comparison, American family insurance vs state farm

To get a clearer picture of their financial strength, here’s a breakdown of some key metrics:

| Metric | American Family Insurance | State Farm | Summary |

|---|---|---|---|

| Financial Strength Rating (A.M. Best, etc.) | Excellent (typically A- or higher) | Excellent (typically A- or higher) | Both maintain exceptionally strong ratings. |

| Market Share | ~7% (approximate) | ~18% (approximate) | State Farm has a considerably larger market share. |

| Net Income (2023 Estimate) | $XX Billion (Estimate) | $YY Billion (Estimate) | Data is not publicly available for 2023, use estimates. |

| Return on Equity (2023 Estimate) | XX% (Estimate) | YY% (Estimate) | Data is not publicly available for 2023, use estimates. |

Note: Exact figures for market share and financial metrics are not readily available for public viewing, and estimates are used in this table. Specific financial data is often proprietary and only accessible to investors or through paid subscriptions.

Policy Features and Benefits

Insurance ain’t just about the basics, fam! It’s about the extras that make your policy a total win. We’re diving deep into the specific perks American Family and State Farm offer, looking at how they stack up, and how they might affect your wallet and peace of mind.

Discounts and Perks

Insurance companies love to throw in discounts to sweeten the deal. These extras can seriously impact the cost of your policy. Some companies offer discounts for things like good driving records, bundling policies, or even for being a homeowner. Smart shoppers always look for these sweet deals!

- American Family Insurance often offers discounts for homeowners, bundling policies (like combining auto and home insurance), and safe driving habits. They also have some niche discounts for things like being a student or having a specific job.

- State Farm is known for its extensive network of discounts, ranging from good student discounts to multi-policy discounts. They also frequently offer discounts based on safe driving records and for those who use certain anti-theft devices.

Unique Policy Benefits

Beyond the typical stuff, some insurers offer unique benefits that can really boost the value of your policy. These perks are designed to make your experience easier and smoother when things go south.

- American Family Insurance often provides comprehensive roadside assistance and rental car coverage, especially for policyholders who are experiencing an accident.

- State Farm often includes accident forgiveness, which can be a lifesaver if you have a minor accident that could affect your premiums in the future. Plus, they often provide options for emergency assistance, such as help with finding lodging and temporary housing if you’re in a tough spot after an accident.

Impact on Cost and Value

Discounts and unique benefits can significantly impact your policy’s overall cost and value. Bundling policies can often lead to substantial savings, and accident forgiveness can protect you from future premium increases.

Customer Needs and Policy Choice

Choosing between policies is all about what you need and value. A family with multiple vehicles might benefit more from bundled discounts, while someone with a pristine driving record might prioritize accident forgiveness.

Policy Feature Comparison

| Feature | American Family Insurance | State Farm | Summary |

|---|---|---|---|

| Discounts | Homeowner, bundling, safe driving | Good student, multi-policy, safe driving, anti-theft | Both offer significant discounts, but the specifics vary. |

| Bundled Services | Roadside assistance, rental car coverage | Accident forgiveness, emergency assistance | Different approaches to bundled services. |

| Additional Benefits | Comprehensive roadside assistance | Accident forgiveness, options for emergency assistance | Each offers a unique set of perks. |

Geographic Availability and Local Offices

Yo, fam! Navigating insurance can be a total drag, especially when you’re trying to find the right coverage in your area. Knowing where each company’s got a strong presence is key to getting the best service, so let’s dive into the nitty-gritty.Understanding where these insurance giants have roots is crucial for getting the support you need, whether it’s a claim or a policy tweak.

This section’s gonna break down their reach, from coast to coast, and even look at local offices and agents, making it easy for you to find the best fit for your needs.

American Family Insurance’s Regional Presence

American Family Insurance boasts a widespread network, ensuring coverage across various states. Their presence is especially strong in the Midwest and parts of the East Coast, with a substantial presence in the states that form the heartland. This widespread network allows for easier access to local agents and support.

American Family Insurance’s coverage extends to a significant portion of the US, providing broad support for customers nationwide.

- Midwest: Strong presence in states like Wisconsin, Minnesota, and Iowa.

- East Coast: Notable coverage in states like Pennsylvania, New York, and New Jersey.

- Plains States: Significant operations in states like Nebraska, Kansas, and South Dakota.

- Southern States: Growing presence in several Southern states, including Missouri and Arkansas.

State Farm’s Nationwide Reach

State Farm, a true nationwide giant, has a near-ubiquitous presence, making them readily available in virtually every state across the country. Their extensive network of agents and local offices ensures convenient access to support.

State Farm’s massive network of local offices and agents allows for convenient support throughout the US.

- West Coast: Dominant presence in California, Washington, and Oregon.

- Midwest: Widely recognized in states like Illinois, Indiana, and Ohio.

- East Coast: Extensive presence in states like New York, Massachusetts, and Florida.

- South: Strong presence throughout the Southern states, including Texas, Louisiana, and Georgia.

Comparing Local Office Accessibility

State Farm’s vast nationwide presence makes local offices readily available in most locations. This widespread network facilitates easy access to agents and support. American Family Insurance, while not as ubiquitous, still maintains a strong presence in key areas, particularly in the Midwest and parts of the East Coast. The availability of local offices and agents often correlates with the density of customers in specific areas.

The availability of local offices and agents often reflects the concentration of customers in specific regions.

Customer Service Reach

Both companies have robust customer service networks, providing support through phone, online portals, and sometimes even in-person visits. State Farm’s extensive network, due to its nationwide reach, provides broader access to support across all states. American Family Insurance’s concentrated presence in key areas translates to strong local customer support in those regions.

Customer service networks vary depending on the company’s presence in different regions.

Visual Representation of Geographic Coverage

(Unfortunately, I can’t display images. Imagine a map of the US with shaded areas representing the geographic coverage of each company. Darker shades would represent a stronger presence, while lighter shades would indicate a more limited reach. The State Farm map would have virtually every state shaded, while American Family’s map would have stronger shading in the Midwest and parts of the East Coast.)

Pricing and Value Proposition

Pricing strategies for insurance are like choosing the right outfit – you gotta find the perfect fit for your needs and wallet. Both American Family and State Farm employ different tactics to attract customers, and understanding these strategies can help you make the best choice for your specific situation. It’s all about finding the best deal that aligns with your driving habits and location.

Pricing Strategies Employed by Each Company

American Family and State Farm use various methods to determine insurance premiums. American Family often emphasizes bundling services like home and auto insurance for a potential discount. State Farm, on the other hand, might offer tailored discounts for specific driver profiles, like safe driving records or low mileage.

Value Proposition Comparison

The value proposition of each company hinges on more than just price. American Family often positions itself as a family-friendly brand, offering comprehensive coverage options at potentially competitive rates. State Farm, with its long history and widespread presence, frequently highlights its broad network of local agents and claim handling resources. Ultimately, the “best” value depends on your personal needs and preferences.

Pricing Variations Based on Location and Driving History

Insurance rates are like a chameleon – they shift based on your location and driving record. In high-risk areas with a lot of accidents, premiums tend to be higher. Similarly, drivers with a history of violations or accidents will pay more.

Example of Pricing Variation

| Scenario | American Family Premium | State Farm Premium |

|---|---|---|

| Young driver, urban location, minor accident | $1,800 | $1,950 |

| Experienced driver, rural location, no accidents | $1,200 | $1,300 |

| Family with multiple vehicles, suburban area, good driving record | $2,500 | $2,700 |

These examples demonstrate the potential variations. Your actual premium could differ depending on your specific circumstances.

Key Factors Affecting Insurance Cost

Factors like age, location, driving history, and the type of vehicle influence insurance costs. Consider these factors when comparing policies.

Calculating and Comparing Insurance Premiums

To calculate and compare premiums, you need to input your specific details into each company’s online quote tool or speak with an agent. Each company’s pricing model takes into account a multitude of factors.

Premium = Base Rate + (Factors like location, age, driving record, vehicle type)

This formula is a simplification; actual calculations are more complex.

Conclusion

In conclusion, the choice between American Family Insurance and State Farm hinges on individual needs and preferences. This comparison highlights the nuances of each provider, empowering readers to make informed decisions that align with their unique circumstances. Consider the specifics of coverage, customer service, and financial stability before choosing the best fit for your insurance needs.

Common Queries

What are the typical policy deductibles for American Family Insurance and State Farm?

Policy deductibles vary significantly based on the type of coverage and individual circumstances. Refer to the specific policy details for accurate information.

How do the claims processes differ between the two companies?

Both companies have established claims processes, but differences may exist in the specific steps and timelines. Refer to the company websites or contact representatives for detailed procedures.

Are there any discounts available for either company?

Yes, both providers often offer discounts based on factors such as good driving records, multiple policies, or other qualifying circumstances. Review the company websites for the current list of available discounts.

What are the average premium costs for a similar coverage package between the two companies?

Premiums vary widely based on factors such as location, driving history, and coverage choices. A comparison table within the main article details this.