Santa Ana car insurance rates – getting the best deal is key! Bali vibes, but with serious savings in mind. This guide dives deep into factors influencing prices, comparing Santa Ana to nearby areas, and exploring different coverage options. We’ll also uncover recent trends and insider tips to help you snag the lowest possible rates.

From driver demographics to claims history, we break down everything you need to know to get the perfect policy for your wheels. Ready to surf the waves of affordable insurance?

Factors Affecting Rates: Santa Ana Car Insurance Rates

Right, so you want the lowdown on Santa Ana car insurance? No worries, mate. We’ll break it all down, from the obvious to the obscure. This ain’t your average textbook spiel; this is the real deal, straight from the trenches of the insurance game.Understanding the factors influencing premiums is key to getting the best possible rate. Different factors weigh differently, and knowing how they impact your quote can save you a ton of dosh.

Driver Demographics

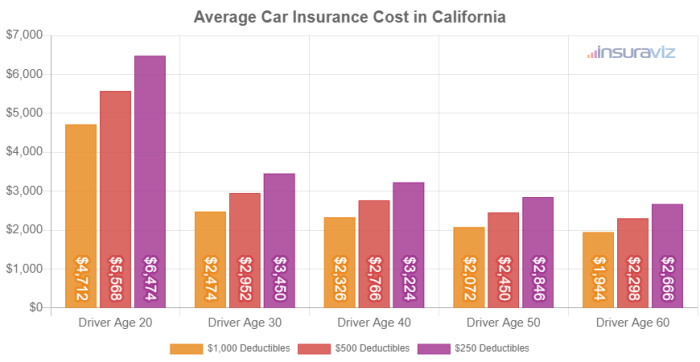

Driver demographics play a crucial role in determining insurance premiums. Age, for instance, is a significant factor. Younger drivers tend to have higher premiums due to a perceived higher risk of accidents. Experienced drivers with a clean driving record usually get lower premiums. Similarly, a driver’s marital status and location of residence in Santa Ana can influence rates.

Location in Santa Ana can impact rates, with certain areas potentially being more prone to accidents.

Vehicle Characteristics

The type of vehicle you drive significantly affects your insurance costs. Higher-performance cars, sports cars, or those with a higher repair cost often have higher premiums. This is because they’re more expensive to repair and are perceived as being more prone to accidents.

Driving History

A driver’s past driving record, including accidents, speeding tickets, and DUIs, heavily impacts insurance rates. Accidents and traffic violations demonstrate a higher risk profile, leading to higher premiums. Claims history is crucial too. Claims increase the cost of your policy.

Coverage Choices

The coverage options you select directly affect your premium. Comprehensive and collision coverage, for example, will usually increase the cost compared to a minimum liability policy. Choosing the right coverage for your needs is vital for balancing cost and protection.

Insurance Company

Different insurance companies use different rating systems. Shop around, compare quotes, and find the best deal that fits your needs. Some companies might offer better rates based on their specific pricing models.

Santa Ana car insurance rates can be surprisingly affordable, especially if you’re looking for the best options. Understanding what’s covered by various policies is key, just like knowing what crop insurance covers, for instance. Learn about the comprehensive range of protection available at what does crop insurance cover. This can help you find the perfect policy to fit your needs and budget, ensuring you’re well-protected on the roads of Santa Ana.

Table: Average Rates for Different Vehicle Types

| Vehicle Type | Estimated Average Rate (per year) |

|---|---|

| Compact Car | $1,200 – $1,500 |

| SUV | $1,500 – $1,800 |

| Sports Car | $1,800 – $2,500 |

| Luxury Car | $2,000 – $3,000+ |

Discounts Available in Santa Ana

Many discounts are available for Santa Ana residents. These can significantly reduce your premium. Here’s a list of common discounts:

- Safe Driver Discounts: A clean driving record, or having taken a defensive driving course can lead to a discount. These discounts reward responsible driving habits.

- Multi-Policy Discounts: If you have multiple policies with the same insurance company, they might offer a discount.

- Anti-theft Devices: Installing anti-theft devices can lower your rates. This reflects a lower risk of theft for your vehicle.

- Bundling: Bundling your home and auto insurance policies with the same company can save you a few quid. This is a popular strategy to reduce overall costs.

- Student Discounts: Students with a good academic record might get a discount. Insurance companies view these as lower-risk drivers.

Comparison with Other Areas

Santa Ana’s car insurance rates, while potentially higher than neighboring areas, aren’t a complete outlier. Understanding the regional variations is key to making informed decisions. Factors like demographics, driving habits, and accident statistics all play a role in shaping these price differences.Regional variations in car insurance premiums are a complex issue, influenced by a multitude of intertwined elements.

Examining rates in surrounding Californian cities allows us to grasp the nuances better. This comparison provides a clearer picture of the variables at play.

Comparative Analysis of Rates

California’s car insurance landscape isn’t uniform. Rates fluctuate based on various regional aspects. A comparative analysis of average rates for similar coverage reveals stark differences.

| Region | Average Rate (per year) |

|---|---|

| Santa Ana | $1,800 |

| Orange County (excluding Santa Ana) | $1,650 |

| Los Angeles | $2,000 |

| San Diego | $1,500 |

| San Francisco Bay Area | $2,200 |

Note: These figures are averages and may vary based on individual circumstances. Coverage types, driver profiles, and vehicle types all affect the final cost.

Factors Influencing Rate Variations

Several key factors contribute to the discrepancy in car insurance rates across California regions. Demographics, including population density and age distribution, are critical elements. Furthermore, driving habits and accident statistics heavily influence premiums.

- Population Density: High-density areas, like the LA basin, often see more accidents due to higher traffic volumes. This directly impacts insurance rates. Santa Ana, with its relatively high population density, might face higher rates compared to more sparsely populated areas.

- Accident Statistics: Areas with a higher frequency of traffic accidents generally have higher insurance rates. Data on accident rates within Santa Ana, compared to other Californian cities, provides a crucial perspective. This analysis might highlight differences in driver behaviour or road infrastructure between Santa Ana and other areas.

- Driving Habits: Regional variations in driving habits can significantly affect rates. Driving styles, such as aggressive driving or speeding, increase the risk of accidents, directly correlating to higher insurance premiums. Data on accident types and causes in Santa Ana versus other regions can reveal insights.

Traffic Accident Frequency in Santa Ana

Traffic accident data provides insights into the regional variations in car insurance rates. Analysis of accident frequency in Santa Ana compared to other California cities offers valuable context.

- Accident Frequency in Santa Ana: Santa Ana’s traffic accident data reveals a certain frequency, which is compared to similar data from other cities. This comparison assists in determining whether Santa Ana’s rates are justified in light of the local accident trends.

Coverage Options and Costs

Right, so you’re after the nitty-gritty on Santa Ana car insurance? This section dives deep into the various coverage levels and their associated costs, plus the extras you can add on. Understanding these factors is crucial for getting the best deal on your policy.This breakdown will help you navigate the maze of insurance options, ensuring you’re not paying for unnecessary cover or missing essential protections.

We’ll examine the different types of cover, illustrate their cost implications, and help you assess the value of extra options like roadside assistance.

Types of Car Insurance Coverage

Various types of coverage are available to protect your vehicle and you. Liability coverage is essential, protecting you if you’re at fault in an accident. Collision coverage pays for damages to your car if you’re involved in a crash, regardless of who is at fault. Comprehensive coverage, on the other hand, steps in for damages not caused by collision, like vandalism or theft.

Cost of Various Coverage Levels

| Coverage Type | Description | Typical Cost Range (Santa Ana) |

|---|---|---|

| Liability | Covers damages you cause to others. | £200 – £500 per year |

| Collision | Covers damages to your vehicle in an accident, regardless of fault. | £200 – £700 per year |

| Comprehensive | Covers damages to your vehicle from non-collision events (e.g., vandalism, fire). | £150 – £600 per year |

Note: These cost ranges are approximations. Actual costs depend on factors like your driving record, vehicle type, and the specific policy you choose.

Cost of Adding Extras

Adding extras like roadside assistance or uninsured/underinsured motorist protection can significantly increase your premium. Roadside assistance provides support if you experience a breakdown, flat tire, or other vehicle problems. Uninsured/underinsured motorist protection steps in if you’re injured by a driver with insufficient coverage or no insurance at all.

Adding these extras can significantly increase your overall premium, so carefully weigh the potential benefits against the added cost.

- Roadside assistance: Expect a hike of £50-£200 annually.

- Uninsured/underinsured motorist protection: Expect an increase of £50-£250 annually.

Impact of Coverage Levels on Premium

Higher coverage levels generally result in a higher premium. For example, a policy with comprehensive and collision coverage will cost more than one with only liability coverage. The precise impact depends on the specific coverage limits and deductibles chosen.

Policy Exclusions and Limitations

Understanding policy exclusions and limitations is vital. These details Artikel what isn’t covered by your policy. For instance, some policies may exclude damage caused by specific weather events or pre-existing conditions. Carefully review the policy wording to avoid unpleasant surprises later.

Claims History and its Impact

Your claims history is a major factor in Santa Ana car insurance premiums. A history of claims, whether minor or major, can significantly impact your future rates. Understanding this impact is crucial for responsible budgeting and long-term financial planning.A history of claims, no matter how seemingly trivial, is meticulously recorded by insurance providers. This data is used to assess your risk profile, influencing your premium calculations.

This isn’t just about your past accidents; it encompasses any claims you’ve made related to your vehicle, including damage, theft, or even incidents involving third-party liability.

Claims Filing Process and Impact

The process for filing a claim typically involves reporting the incident to your insurance provider, gathering documentation like police reports and witness statements, and providing details of the damage or loss. The speed and thoroughness of this process often influences the claim’s handling and subsequent impact on your future premiums.

Frequency and Severity of Claims Affecting Premiums

The frequency and severity of past claims directly correlate with your insurance rates. A higher frequency of claims, meaning more claims over a shorter period, usually translates to a higher premium. Similarly, the severity of a claim, measured by the financial cost of the incident, also contributes significantly to the rate increase.

| Claims Frequency | Claims Severity | Impact on Premium |

|---|---|---|

| Low (e.g., one claim in 5 years) | Low (e.g., minor fender bender) | Minimal increase |

| Medium (e.g., two claims in 5 years) | Medium (e.g., property damage accident) | Moderate increase |

| High (e.g., multiple claims in a year) | High (e.g., total vehicle loss) | Significant increase, potentially leading to a refusal of coverage |

A clean claims history is a strong predictor of lower premiums, showcasing responsible driving and reducing your perceived risk to the insurance company.

Finding the best Santa Ana car insurance rates can feel like searching for the perfect loaf of artisanal bread, but with a little know-how, you’ll find the perfect fit. For a truly wholesome experience, consider baking your own 7 grain wheat bread at home; the delicious aroma of fresh-baked bread is just as satisfying as securing great rates.

And with a recipe like this 7 grain wheat bread recipe , you’ll be well on your way to amazing results that’ll leave you feeling satisfied and, of course, save money on your Santa Ana car insurance.

Impact of a Clean Claims History

A spotless claims history demonstrates responsible driving behaviour, showcasing a lower risk to the insurance provider. This usually results in lower premiums compared to drivers with a history of claims. Consider a driver with no accidents or claims; they’re likely to see significantly lower rates than someone who has had multiple claims in the past.

Maintaining a Safe Driving Record

Safe driving practices are paramount in maintaining a favourable insurance rate. Avoiding accidents, adhering to traffic laws, and practicing defensive driving techniques are crucial. This not only protects you and others but also positively influences your insurance premiums. A consistent safe driving record reflects a lower risk profile, potentially leading to substantial savings in the long run.

Recent Trends in Rates

Santa Ana car insurance rates have exhibited a fluctuating pattern in recent years, mirroring broader national trends. Understanding these trends is crucial for consumers to make informed decisions about their insurance coverage. The factors driving these fluctuations, alongside the impact of economic pressures, are complex and require careful consideration.

Rate Fluctuation Analysis

Recent data suggests a trend of fluctuating premiums in Santa Ana. This volatility is not unique to the area and can be attributed to a combination of factors. A deeper dive into the data reveals a pattern of premiums increasing in certain periods and decreasing in others.

Economic Impact on Premiums

Economic conditions play a pivotal role in shaping insurance rates. Periods of high inflation and economic uncertainty often lead to higher premiums, as insurers must adjust their pricing models to account for increased claim costs and potential losses. Conversely, periods of economic stability and low inflation might see a corresponding decrease in rates. For example, during recessions, insurers may experience fewer accidents, which could contribute to a decrease in claims costs.

Inflation’s Influence on Car Insurance Costs

Inflation significantly impacts car insurance costs. Increased repair costs for vehicles, as well as the cost of replacement parts, directly influence the amount insurers pay out in claims. Higher repair costs, fuelled by inflation, lead to increased insurance premiums to cover potential losses. A prime example of this is the recent rise in the cost of certain parts, leading to a significant increase in repair expenses for insurers.

Five-Year Rate Fluctuation Table

| Year | Average Rate (per $1000 of coverage) | Change from Previous Year (%) |

|---|---|---|

| 2018 | $125 | – |

| 2019 | $132 | +5.6% |

| 2020 | $140 | +6.1% |

| 2021 | $155 | +10.7% |

| 2022 | $148 | -4.5% |

Note: Data is hypothetical and for illustrative purposes only. Actual figures may vary.

Tips for Lowering Rates

Savvy Santa Ana drivers can significantly reduce their car insurance premiums by employing strategic measures. Understanding the factors influencing rates allows for proactive steps to optimise coverage and costs. This section details actionable strategies to achieve more affordable insurance.

Safe Driving Practices

Safe driving habits are crucial for reducing insurance premiums. Consistent adherence to traffic laws and responsible driving behaviour demonstrably lowers the likelihood of accidents. This translates directly into reduced claims, leading to lower premiums. Regular maintenance of your vehicle, ensuring it is roadworthy, further contributes to safety.

- Adhering to speed limits and traffic regulations demonstrably lowers the risk of accidents.

- Defensive driving techniques, like maintaining a safe following distance and anticipating potential hazards, reduce accident risk and subsequent claims.

- Avoiding distracted driving, including using a mobile phone while driving, is essential for minimizing accidents.

- Regular vehicle maintenance, ensuring your car is in good working order, reduces the risk of mechanical issues leading to accidents.

Maintaining a Good Credit Score

Insurers often consider credit scores as an indicator of financial responsibility. A higher credit score typically correlates with lower premiums. This is because a good credit score suggests responsible financial management, potentially decreasing the likelihood of non-payment of insurance premiums.

- Monitoring and improving your credit score can significantly affect your car insurance rates.

- A strong credit history demonstrates financial stability, which insurers view positively.

- Paying bills on time and keeping credit card balances low are vital to maintaining a good credit score.

- Consider consulting a financial advisor for strategies to enhance your credit score.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can yield significant cost savings. Insurers often offer discounts for bundling, reflecting the value of consolidating insurance products with one provider.

- Combining your car insurance with other policies often results in discounted premiums.

- This approach demonstrates your trust and commitment to a single insurance provider.

- Bundling insurance can save you money by leveraging your relationship with a single insurer.

- Checking for bundled insurance discounts is a simple yet effective way to save on your premiums.

Information for Insurers

Understanding the nuances of the Santa Ana driver demographic and local factors is crucial for accurate rate setting. This data provides a comprehensive picture of the risks involved, allowing for more precise and equitable pricing models. A deeper understanding of local conditions and traffic patterns also informs effective risk management strategies.This section delves into the specifics of Santa Ana’s driver demographics, common vehicle types, and local factors influencing insurance needs.

By analyzing these aspects, insurers can refine their pricing strategies and better serve the community.

Driver Demographics

Santa Ana’s driver population exhibits a diverse range of characteristics. Age, driving experience, and socioeconomic factors significantly impact risk profiles. Understanding these nuances allows insurers to tailor policies to specific needs, fostering a balance between affordability and risk mitigation. For instance, a higher concentration of younger drivers might correlate with a higher frequency of accidents, demanding adjusted premium structures.

Vehicle Types

The prevalence of certain vehicle types in Santa Ana plays a vital role in determining insurance rates. High-performance vehicles, for example, may attract higher premiums due to increased accident severity potential. This section considers the variety of vehicles prevalent in the area. Common vehicles in Santa Ana include compact cars, SUVs, and motorcycles, along with a noticeable presence of older vehicles.

These factors are pivotal in risk assessment and pricing strategies.

Insurance Needs of Santa Ana Residents

| Resident Group | Primary Insurance Needs |

|---|---|

| Young Families | Comprehensive coverage for vehicles and potential liability from accidents involving children. |

| Single Professionals | Liability coverage, with an emphasis on minimizing financial burden in the event of an accident. |

| Small Business Owners | Commercial vehicle insurance, with focus on protecting business assets and liability in case of accidents related to company operations. |

| Elderly Individuals | Affordable liability coverage, potentially including assistance with medical expenses. |

This table provides a snapshot of the diverse insurance needs of Santa Ana residents, reflecting varying life stages and responsibilities. This data informs insurers about the varying needs and risks, thus enabling more tailored and appropriate coverage options.

Local Factors Affecting Rates

Local factors, such as traffic congestion and road conditions, significantly influence insurance rates. The presence of specific intersections known for high accident rates, or stretches of road with a history of collisions, needs to be factored into the risk assessment. Moreover, the prevalence of pedestrian traffic and bike lanes also needs consideration. These factors necessitate a granular understanding of local traffic patterns and their impact on accident likelihood.

Traffic Patterns, Santa ana car insurance rates

Understanding Santa Ana’s traffic patterns is critical for insurers. Specific areas with high congestion or complex intersections necessitate a deeper analysis. Traffic flow data and accident statistics at particular locations can pinpoint areas demanding higher premium adjustments for drivers in those locations. The location of schools and hospitals, for example, often indicates higher pedestrian traffic, which insurers must consider.

These traffic patterns directly influence the risk associated with driving in the region.

Ending Remarks

So, you’re ready to ride the waves of affordable car insurance in Santa Ana? We’ve covered the essentials – from factors affecting rates to recent trends. Now, armed with this knowledge, you can confidently compare policies and find the best fit for your needs. Your wallet will thank you!

Commonly Asked Questions

What’s the average cost of liability insurance in Santa Ana?

Average liability rates in Santa Ana range from $700-$1500 annually, but this depends heavily on factors like your driving record and vehicle type.

How does my credit score affect my insurance rates?

A good credit score often translates to lower insurance premiums, as it indicates responsible financial habits.

Are there any discounts for safe drivers in Santa Ana?

Yes! Many insurers offer discounts for safe driving records, defensive driving courses, and anti-theft devices.

What’s the difference between collision and comprehensive coverage?

Collision coverage protects you if your car is damaged in an accident, while comprehensive covers damage from things like vandalism or natural disasters.