An insured pays an annual premium to his insurer, a fundamental transaction underpinning the intricate web of modern insurance. This transaction, while seemingly straightforward, involves a complex interplay of factors, from the insured’s responsibilities to the insurer’s strategic management of premium income. Understanding the nuances of this exchange reveals a vital mechanism in the economic landscape, impacting both individual financial security and the overall health of the insurance industry.

The process begins with the insured’s understanding of the factors influencing premium amounts, encompassing risk assessment, policy type, and actuarial science. The insured’s choices in payment methods, from automatic transfers to manual submissions, impact their own financial well-being and the insurer’s operational efficiency. The insurer, in turn, employs premium income for claim settlements, operational costs, and strategic investments, ensuring financial stability and sustainability.

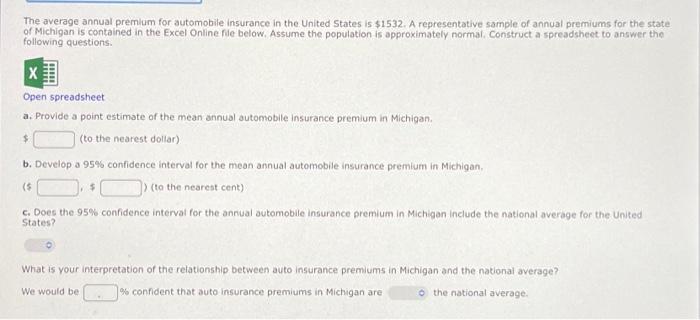

Understanding Insurance Premiums

An annual premium is the fixed amount an insured person pays to their insurer each year for a particular insurance policy. This payment covers the potential costs associated with a covered event, ensuring the policyholder is protected against financial losses. Essentially, it’s a pre-emptive payment for potential future claims.Insurance premiums aren’t static; they vary based on several factors, making the cost of one policy quite different from another.

Understanding these influencing elements is crucial for anyone considering or already holding an insurance policy.

Factors Influencing Premium Amounts

Premiums aren’t arbitrary; they’re calculated using statistical models and risk assessments. Various factors significantly affect the final price, making them quite complex.

- Risk Assessment: Insurance companies evaluate the likelihood of a claim occurring for a particular policyholder or group of policyholders. This is a core component of the process, as a higher perceived risk leads to a higher premium. Factors like age, location, driving record (for auto insurance), and health conditions (for health insurance) are carefully analyzed to estimate the probability of a claim.

For example, a younger driver with a poor driving record might have a much higher auto insurance premium compared to an older driver with a clean record.

- Policy Type: Different insurance policies cater to various needs and risks. Health insurance, life insurance, auto insurance, and homeowners insurance, for instance, have vastly different premiums. The coverage amount and the type of risk insured also play a significant role. A homeowner’s insurance policy with a high coverage amount for a large house in a high-risk area will have a significantly higher premium compared to a policy with a lower coverage amount for a smaller home in a lower-risk area.

- Coverage Amount: The amount of financial protection offered by the policy directly impacts the premium. A higher coverage amount generally means a higher premium because the insurer is taking on a greater financial risk. For example, a life insurance policy with a higher death benefit will typically have a higher premium than one with a lower death benefit.

- Deductibles and Co-pays: These are out-of-pocket costs the policyholder must pay before the insurance company covers the remaining expenses. Lower deductibles and co-pays usually translate to higher premiums, as the insurer is assuming a smaller portion of the potential costs. For instance, a health insurance policy with a lower deductible will likely have a higher premium compared to a policy with a higher deductible.

- Actuarial Science: Insurance companies use actuarial science, which is a mathematical approach, to predict the likelihood and cost of future claims. Actuarial tables are used to assess risk and set premiums. A more precise actuarial model leads to a more accurate premium calculation, which results in fairer premiums for the policyholders.

Premium Calculation Methods

Insurance companies use sophisticated methods to determine premiums. The core of this process relies on understanding and quantifying risk.

- Statistical Analysis: Insurers analyze historical claim data to understand the patterns of claims. This data is crucial in determining the likelihood of future claims and the associated costs. For instance, historical data on car accidents in different regions allows insurers to adjust premiums based on the risk level of each region.

- Risk Assessment Models: Sophisticated models are employed to assess the risk associated with each policy. These models combine various factors, such as age, location, and driving history, to determine the probability of a claim occurring. This helps the insurer to better predict the future risk, which is then used to calculate the premium.

- Actuarial Tables: These tables provide estimates of the average cost of claims based on factors like age, gender, or location. This data, combined with statistical analysis, is used to calculate premiums. For example, a higher average cost of medical care for a specific age group would result in a higher premium for health insurance policies for that age group.

Relationship Between Risk and Premium Costs

A fundamental principle of insurance is the direct correlation between risk and premium. The higher the risk of a claim, the higher the premium.

A higher risk of a claim event leads to a higher premium to compensate for the increased likelihood of payouts.

This relationship ensures that insurers can cover their costs and maintain financial stability. For example, a policy covering high-value jewelry will have a higher premium compared to one covering standard household goods due to the higher potential financial loss in the first case.

The Insured’s Perspective

Understanding insurance premiums is crucial for any policyholder. Beyond the basics of what you pay, knowing your responsibilities and options regarding premium payments is equally important. This section will delve into the insured’s role in managing these payments, exploring the various payment methods, potential consequences of missed payments, and the importance of understanding your policy’s terms.Knowing your rights and responsibilities regarding insurance premiums empowers you to manage your policy effectively and avoid potential issues.

This involves understanding the different payment options available, the implications of late or missed payments, and the importance of carefully reviewing your policy’s terms.

Insured’s Responsibilities Regarding Premium Payments

The insured has a clear responsibility to ensure timely premium payments. This commitment is fundamental to maintaining active coverage under the policy. Failure to meet these obligations can result in the policy lapsing, potentially leaving the insured without coverage when they need it most.

Different Payment Options for Premiums

Several payment methods are available to insureds. These options cater to varying preferences and financial situations. Understanding these choices allows you to select the most convenient and suitable method for your needs.

- Automatic Payment:

- Manual Payment:

- Other Options:

Setting up automatic payments through your bank or credit card ensures your premiums are paid on time every billing cycle. This eliminates the risk of missed payments and associated penalties. An example would be a homeowner setting up an automatic debit from their checking account to pay their home insurance premium monthly.

Manual payment methods, such as sending a check or money order, offer flexibility in terms of when you pay. However, there’s a higher risk of late payments if not carefully managed. A business owner might choose this method if they prefer to keep track of payments manually.

Insurers may offer other options such as online payment portals or payment apps, which offer convenience and often allow for tracking payment history. These methods can often be accessed through the insurer’s website.

Implications of Late or Missed Premium Payments

Failure to pay premiums on time can have significant consequences. Understanding these implications is essential for responsible policy management. Late payments may incur penalties or fees, and in severe cases, can lead to policy cancellation. This loss of coverage means you are no longer protected by the insurance policy. A missed payment for auto insurance, for example, could result in the cancellation of coverage, leaving you without protection in the event of an accident.

Importance of Understanding Policy Terms

Carefully reviewing your policy’s terms and conditions regarding premium payments is critical. These terms Artikel the payment schedule, acceptable payment methods, late payment penalties, and the consequences of non-payment. By understanding these specifics, you can proactively manage your premiums and avoid potential issues. Misinterpreting these terms can result in unnecessary financial burdens or even the loss of coverage.

Comparison of Payment Methods

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Automatic Payment | Convenience, avoidance of late fees, usually a reduced administrative burden | Potential for overdraft if funds are insufficient, limited flexibility |

| Manual Payment | Flexibility, often allows for adjustments in payment amounts | Risk of late payments, increased administrative burden |

| Other Options (e.g., Online Payment Portals, Payment Apps) | Convenience, often offer payment history tracking, potential for real-time notifications | May require technical proficiency or access to online services, potentially subject to service interruptions |

The Insurer’s Perspective

Insurance companies, or insurers, are businesses that operate on the principle of pooling risk. They collect premiums from policyholders, essentially spreading the financial burden of potential losses across a large group. This allows them to provide coverage for unforeseen events, while also maintaining profitability. Understanding how insurers manage these premiums is crucial for both policyholders and the industry as a whole.

Premium Income Management

Insurers meticulously manage premium income to ensure they can meet their obligations to policyholders while maintaining financial stability. This involves a complex process of allocation and investment. Premiums aren’t simply stored in a vault; they’re used to cover claims, pay operational expenses, and generate further income through investment.

Uses of Premium Income

Premium income serves several critical functions for insurers. A significant portion is allocated directly to cover claims arising from insured events. This includes everything from car accidents to home fires, and medical expenses. Another substantial portion is used to cover administrative costs, marketing, and other operational expenses required to run the business. The remainder is typically invested to generate additional income, further bolstering the insurer’s financial position.

Claim Cover and Operating Costs

The primary use of premium income is to pay out claims. Insurers meticulously track and assess claims, ensuring that payments are accurate and in line with policy terms. Operating costs, encompassing everything from salaries to office space, are also met from premium income. Efficient management of these costs is critical for profitability and long-term sustainability.

Financial Stability

A healthy inflow of premium income is vital for an insurer’s financial stability. This income forms the bedrock of the business, allowing them to meet current obligations and invest for future growth. Without a reliable stream of premiums, insurers face significant challenges in fulfilling their commitments and maintaining a solid financial foundation. Sufficient premium income also allows the insurer to invest in risk assessment and mitigation strategies.

This, in turn, helps to reduce the likelihood of large, unforeseen claims.

Revenue Stream Breakdown

The table below illustrates the typical distribution of revenue streams for a hypothetical insurer.

An insured’s annual premium payment to their insurer is a cornerstone of the insurance industry, a critical investment in security. Understanding the intricacies of the Cape Verde insurance industry market, as detailed in this insightful resource cape verde insurance industry market , reveals how these payments are crucial for supporting a robust and thriving insurance ecosystem. Ultimately, this calculated premium ensures a safety net for individuals and businesses, safeguarding against unforeseen circumstances.

| Revenue Stream | Percentage | Description |

|---|---|---|

| Premiums | 70% | Annual payments from policyholders |

| Investment Income | 20% | Returns from investments of premium funds |

| Other Income | 10% | Fees, commissions, and other sources |

Insurers rely on a diverse portfolio of revenue sources, with premiums being the largest contributor. This ensures financial resilience in a dynamic market environment.

Impact of Premiums on the Economy

Insurance premiums aren’t just a cost for individuals and businesses; they play a vital role in the overall health and function of the economy. Their movement and distribution have tangible effects on various sectors, from financial institutions to local businesses. Understanding this impact is crucial for assessing the overall economic picture.Insurance premiums are a significant source of revenue for insurers, who then use this money to cover claims and manage their operations.

This, in turn, creates a ripple effect throughout the economy, stimulating activity in related industries.

Role of Premiums in Economic Activity

Premium payments contribute substantially to economic activity. Insurers use these funds to invest in various assets, including bonds and stocks. These investments circulate capital within the financial markets, fostering economic growth. The investments made by insurers often benefit a wide range of businesses, from small startups to large corporations.

Premium Payments and Business Support

Premium payments are a critical source of funding for businesses. For example, many businesses purchase liability insurance, which helps to protect them from potential lawsuits and financial losses. This protection allows businesses to operate with greater confidence, invest in expansion, and create new jobs. Moreover, the availability of insurance often influences investment decisions by encouraging businesses to take on more risk, thereby promoting innovation and entrepreneurship.

Premium Payments and Individual Support

Insurance premiums protect individuals from significant financial burdens in case of unexpected events like accidents, illnesses, or property damage. This financial safety net allows individuals to pursue opportunities and investments without undue anxiety about potential catastrophes. It fosters stability and allows for greater economic participation and growth by individuals.

Impact of Fluctuating Premium Costs on Consumer Behavior

Fluctuations in premium costs directly impact consumer behavior. Higher premiums can discourage individuals from purchasing certain types of insurance or encourage them to seek out less expensive options. This can lead to a reduction in the overall demand for insurance products and services, potentially affecting the profitability of insurance companies. Conversely, falling premium costs can increase consumer demand and encourage individuals to purchase broader insurance coverage.

Visual Representation of Premium Flow, An insured pays an annual premium to his insurer

Imagine a large circle representing the overall economy. Premium payments flow into this circle from individuals and businesses. A portion of these funds is directly used to pay for claims. Another significant portion is invested in financial instruments, which then circulates back into the economy through various channels, including stock market investments and bond purchases. This cycle of premium payments, claims, and investments creates a constant flow of capital throughout the economy, fostering economic activity and stability.

The money used for investments also creates jobs and generates additional income for businesses involved in providing goods and services.

Premium Payment Strategies: An Insured Pays An Annual Premium To His Insurer

Paying your insurance premiums on time is crucial for maintaining your policy’s validity. A well-structured approach to premium payments can also influence your overall financial health and even your relationship with your insurance provider. Understanding various payment options and developing a budget for these costs can make a significant difference.Effective premium management involves more than just timely payments.

It’s about planning ahead, understanding the different payment methods available, and making informed choices that align with your financial situation. This section will explore strategies for managing your insurance premiums, from choosing the right payment method to creating a budget that incorporates these costs.

Strategies for Managing Premium Payments

Consistent premium payments demonstrate responsible financial habits, fostering a positive relationship with your insurer. A history of on-time payments can lead to better service and potentially even discounted rates in the future. Several strategies can help you stay on top of your premium obligations.

Different Premium Payment Options

Various payment options are available to policyholders, each with its own advantages and disadvantages. Understanding these options can help you choose the method that best suits your needs and financial circumstances. Common options include monthly installments, annual payments, or even electronic transfers.

Just as an insured pays an annual premium to his insurer for protection against unforeseen circumstances, proactive maintenance is crucial for safeguarding your vehicle’s health. A seemingly minor issue like coolant leaking from the thermostat housing coolant leaking from thermostat housing can quickly escalate into a costly repair. Understanding these potential problems and taking preventative measures, like regular checks, is just as vital as your insurance policy, ensuring your investment remains secure and dependable.

Ultimately, both insurance and preventive maintenance contribute to peace of mind and financial well-being.

- Monthly Installments: Dividing the annual premium into smaller, monthly payments can make it easier to budget and manage your finances. However, the interest charged on a loan may offset any potential savings from this strategy.

- Annual Payments: Paying the entire premium in one lump sum at the start of the policy year can sometimes lead to a lower premium overall due to the lower administrative costs for the insurer. This might be a better choice if you have a stable income stream.

- Electronic Transfers: Automatic payments through bank transfers or online portals ensure timely payments, reducing the risk of missed payments and potential policy lapses. These are generally preferred due to the reduced chance of forgetting or delaying a payment.

Budgeting for Insurance Premiums

Creating a budget that includes insurance premiums is essential for financial stability. Incorporating these costs into your monthly or annual budget helps you avoid unexpected financial strain and ensures you can meet your obligations. Consider using budgeting apps or spreadsheets to track your income and expenses, allocating a specific portion of your budget to insurance premiums.

Impact of Consistent Premium Payments on Policyholder Relationships

Consistent premium payments demonstrate a policyholder’s commitment to the insurance contract. This commitment is often viewed positively by insurance companies, potentially leading to better customer service, expedited claims processing, and even future rate reductions. A history of on-time payments can build trust and foster a more collaborative relationship between the policyholder and the insurer.

Financial Tips to Save Money on Insurance Premiums

Implementing certain financial strategies can potentially lower your insurance premiums. These tips can help you save money while maintaining adequate coverage.

- Shop Around for Competitive Rates: Comparing quotes from different insurers is essential to find the most competitive rates. Using online comparison tools can simplify this process, helping you discover options that might offer better value for your coverage.

- Increase Deductibles to Reduce Premiums: Increasing your deductible can often lead to lower premiums. This strategy involves accepting a higher financial responsibility in case of a claim, but it can be a viable option for those comfortable with potential out-of-pocket costs.

- Bundle Insurance Policies for Discounts: Many insurers offer discounts for bundling multiple policies, such as auto and homeowners insurance, under one provider. This can significantly reduce your overall insurance costs.

Ending Remarks

In conclusion, the annual premium, a cornerstone of insurance, establishes a reciprocal relationship between insured and insurer. It is a transaction that directly influences the economic well-being of both parties, contributing to individual security and industry stability. The factors impacting premium amounts, payment methods, and the insurer’s utilization of funds are interconnected elements that must be meticulously understood to maximize the benefits of insurance.

FAQ Section

What are the common methods for paying insurance premiums beyond automatic and manual payments?

Insurers often offer payment options through online portals, mobile apps, or even direct debits from bank accounts. These options aim to provide convenience and flexibility to the insured.

How do insurers invest premium funds?

Insurers invest premium funds in various avenues, including government bonds, stocks, and other financial instruments, to generate returns that support future claims and maintain financial stability. Investment strategies are crucial for managing the long-term viability of the insurer.

What are the consequences of consistently late premium payments?

Late or missed premium payments can result in penalties, policy lapses, or even the cancellation of coverage. Understanding the specific policy terms and payment deadlines is critical to avoid these negative consequences.

How do fluctuating premium costs affect consumer behavior?

Fluctuations in premium costs can influence consumer choices, prompting them to seek alternative policies, shop for competitive rates, or adjust their risk profiles to minimize costs. This, in turn, affects the overall insurance market dynamics.