City National Bank Crystal Visa Infinite is the ultimate card for the discerning spender. It’s not just a credit card; it’s a lifestyle upgrade. Imagine effortlessly scoring awesome rewards on everything from fancy dinners to far-off travels. This card unlocks a world of exclusive perks and top-notch financial tools, all while keeping your finances in check. Get ready to level up your spending and experience the premium lifestyle.

This card’s rewards program is designed to maximize your earning potential, and the exclusive perks are truly worth noting. The card offers a sleek design and a user-friendly platform, making it easy to track your spending and manage your rewards.

Overview of the City National Bank Crystal Visa Infinite Card

This isn’t your grandma’s credit card. The City National Bank Crystal Visa Infinite card is a luxurious, high-end credit card designed for those who appreciate the finer things in life… and maybe a little extra bling. Think gourmet coffee, private jet travel, and enough rewards to fund a small island nation.The card boasts a plethora of perks, from enhanced travel benefits to exclusive concierge services.

It’s essentially a status symbol, a statement piece for those who want to show the world they’ve arrived. However, it’s not just about the flash; it’s about the functionality and the potential for serious savings.

Key Features and Benefits

The Crystal Visa Infinite card isn’t just pretty; it’s packed with practical advantages. It’s more than just a way to pay for things; it’s an investment in your lifestyle.

- Luxury Travel Benefits: Imagine seamless airport experiences, complimentary lounge access, and priority boarding. These perks can transform a tedious journey into a luxurious escape, saving you time and stress. Think of that long-haul flight; now you can relax in comfort, knowing your Crystal Visa Infinite card has your back (and your seat).

- Elevated Concierge Services: Need a Michelin-starred restaurant reservation, a private concert ticket, or a bespoke suit tailored to your exact specifications? The dedicated concierge service will handle it all. It’s like having a personal assistant dedicated to making your life easier and more enjoyable. No more frantic searching for the perfect table or battling ticket scalpers. This card handles it all.

- Impressive Rewards Program: Earn points on every purchase, redeemable for flights, hotels, or merchandise. Imagine accumulating enough points to pay for a weekend getaway to a tropical paradise. It’s a potent tool to earn back on your spending.

- Extensive Protection Coverage: From travel insurance to purchase protection, this card safeguards your financial interests. Imagine your luggage getting lost or your new gadget breaking down. The Crystal Visa Infinite card ensures your experience stays smooth, whether you’re on vacation or just shopping for groceries.

Eligibility Requirements

Getting your hands on this exclusive card isn’t a walk in the park. It’s not for everyone. It’s reserved for those who meet specific criteria.

- High Credit Score: A strong credit history is a must. Think of it as a passport to entry, proving your financial responsibility and stability. A high credit score demonstrates a history of responsible financial management. This assures the bank of your ability to handle the financial responsibility associated with the card.

- Significant Income: This isn’t a card for budget travelers. Demonstrating a substantial income level is crucial. The bank wants to ensure that you can comfortably handle the card’s spending potential. A high income shows you can handle the financial responsibility associated with the card.

- Established Financial History: A certain level of financial experience is expected. The bank needs to be convinced you’re a reliable and responsible financial steward. This history assures the bank of your consistent financial stability and your ability to handle the financial responsibility associated with the card. This is a significant factor in the card’s application process.

Rewards and Perks: City National Bank Crystal Visa Infinite

So, you’re eyeing the City National Bank Crystal Visa Infinite? Fantastic! But beyond the sleek design (which, let’s be honest, is pretty snazzy), what about theactual* rewards? Are we talking caviar-and-champagne-worthy perks, or just another pretty face? Let’s dive into the juicy details!The City National Bank Crystal Visa Infinite isn’t just about looking good; it’s about maximizing your spending power and turning your everyday purchases into something a little more… rewarding.

Think of it as a VIP pass to a world of exclusive experiences, all while racking up points that could fund your next lavish getaway.

Reward Structure

The reward structure is designed to turn your spending into something valuable. It’s not just about accumulating points; it’s about how you can use those points to make the most of your money. The specific earning rates, redemption options, and potential bonuses are all designed to make your financial life a little more luxurious. Essentially, the reward structure acts as a powerful incentive to use the card for your everyday spending.

Point Earning Rates

The card offers varying earning rates depending on the type of spending. For example, you might earn a certain number of points for dining, travel, and entertainment. It’s not a one-size-fits-all approach, but rather a strategic system to encourage specific spending habits.

Redemption Options

Redeeming your points is where the real magic happens. The card likely offers various redemption options, allowing you to convert your points into travel, merchandise, or statement credits. It’s crucial to understand the specific terms and conditions to make the most of your rewards.

Potential Bonuses

Bonus points for specific activities or spending thresholds are a great way to boost your rewards. These bonuses can be substantial, adding significant value to your overall reward program. Think of them as extra sprinkles on top of an already delicious dessert!

Comparison to Other Premium Cards

| Card | Points/Miles Earned | Redemption Options | Annual Fee |

|---|---|---|---|

| City National Bank Crystal Visa Infinite | (Specific earning rates need to be provided) | (Specific redemption options need to be provided) | (Specific annual fee needs to be provided) |

| American Express Platinum | (Specific earning rates need to be provided) | (Specific redemption options need to be provided) | (Specific annual fee needs to be provided) |

| Chase Sapphire Reserve | (Specific earning rates need to be provided) | (Specific redemption options need to be provided) | (Specific annual fee needs to be provided) |

The table above provides a basic framework for comparison. Remember, each card has its own nuances and specifics. Comparing these factors directly, in a well-structured table, is essential to make informed decisions. The best card for you depends on your spending habits and preferences.

Exclusive Perks

The perks are where the fun really begins. Exclusive access to airport lounges, concierge services, and travel benefits could be game-changers for frequent travelers. These perks aren’t just for show; they add real value to your overall experience with the card. Imagine the ease of navigating an airport or the convenience of personalized assistance – those are the perks that truly make a difference.

Financial Management Tools

Tired of spreadsheets that look like hieroglyphics? The Crystal Visa Infinite isn’t just about fancy perks; it’s about making your financial life smoother, like a perfectly poured martini. These tools help you keep track of your spending, budgeting, and overall financial health – without making you want to hide under the covers.The card’s financial management tools are designed to empower you to take control of your money, not be controlled by it.

These integrated features act like a personal financial assistant, offering insights and guidance to help you make informed decisions. They work seamlessly with other financial accounts, making your entire financial ecosystem more interconnected and manageable.

Spending Tracking

Tracking your spending is no longer a chore, but a fun game of financial detective work. The card’s integrated spending tracker gives you a detailed breakdown of your expenses, categorizing them to show where your money is going. This allows you to identify spending patterns and pinpoint areas where you can save. Think of it as a financial GPS, guiding you toward smarter spending habits.

Budgeting Tools

Tired of staring blankly at a confusing budget? The card offers budgeting tools that help you create and stick to a realistic budget. These tools can help you visualize your income and expenses, ensuring you stay on track with your financial goals. No more feeling lost in a sea of numbers; these tools provide a clear path to financial well-being.

Online Portals

Accessing your financial information has never been easier. The card provides secure online portals where you can access your account information, track transactions, and manage your budget. This streamlined access means you can monitor your finances anytime, anywhere, without the hassle of endless paperwork. You can view your statements, make payments, and get personalized insights, all in one place.

City National Bank’s Crystal Visa Infinite card offers some compelling perks, but if you’re looking to tap into your home’s equity for a more substantial loan, exploring options like first bank home equity loan might be worthwhile. Ultimately, the best choice depends on your individual financial needs and goals, and the City National Bank Crystal Visa Infinite card remains a strong contender for rewards-focused spending.

Integration with Other Financial Services

The Crystal Visa Infinite’s financial management tools aren’t isolated islands. They seamlessly integrate with other financial services, like checking accounts, savings accounts, and investment platforms. This integrated approach gives you a holistic view of your financial picture, allowing you to make well-rounded decisions about your money. For example, if you link your checking account, the spending tracker will automatically categorize transactions based on your linked accounts, making it even easier to see your financial health at a glance.

Customer Service and Support

Tired of endless hold music and cryptic automated responses? Fear not, Crystal Visa Infinite cardholders! We’ve got you covered with a support system as smooth as your new, fancy credit card. We’ll guide you through the process, from simple questions to serious snags, ensuring your experience is as seamless as possible.Navigating the world of financial services can sometimes feel like deciphering ancient hieroglyphics.

But don’t worry, City National Bank is here to translate the language of customer service. Whether you need to track a transaction, change your billing address, or just have a friendly chat, we’ve got your back.

Customer Service Channels

Various channels are available to contact City National Bank for assistance. This ensures you can access support whenever and wherever you need it. From the comfort of your couch to the bustling streets, you’ll find a way to connect with a helpful representative.

Support Resolution Process

Your inquiries and issues will be handled with efficiency and care. We strive to resolve your concerns quickly and effectively, providing you with the information or assistance you need. Our team is trained to provide prompt and accurate solutions.

Contacting Customer Service

Several ways are available to connect with our dedicated customer service team. Choose the method that best suits your needs and preferences. Don’t hesitate to reach out; we’re here to help.

| Support Channel | Description | Contact Information |

|---|---|---|

| Phone | Our friendly representatives are available to answer your questions and resolve your issues via phone. | (800) 555-1212 (or similar, placeholder number) |

| For inquiries that can be addressed in writing, email is a convenient option. Detailed explanations and attachments can be provided, if necessary. | [email protected] | |

| Online Chat | For quick answers to common questions, live chat is a speedy option. Real-time assistance can resolve your issues promptly. | Available on City National Bank’s website (or similar) |

Spending and Transaction Management

So, you’ve got this fancy Crystal Visa Infinite card, huh? Now, let’s talk about how to actuallyuse* it to maximize those sweet, sweet rewards. Forget spreadsheets, this is about maximizing your fun!Want to turn your everyday spending into a rewards bonanza? Let’s dive into the nitty-gritty of eligible transactions, prioritized spending categories, and any sneaky limitations. It’s all about getting the most out of your card, not just the pretty design.

Eligible Transactions

Your Crystal Visa Infinite card isn’t just for fancy dinners and luxury vacations. It covers a wide range of transactions, from your morning coffee to your evening concert tickets. The key is knowing what’s eligible.

Prioritized Spending Categories

Let’s be honest, some categories get a little more love than others. Think of it as the card’s special interests. Dining and travel are often top priorities, which makes sense, right? You want to maximize your rewards on experiences!

Restrictions and Limitations

Unfortunately, even the most fabulous cards have some limitations. There might be certain merchant categories or transaction types that aren’t eligible for bonus rewards. It’s like a secret code; you need to know the rules to play the game.

Spending Category Rewards

Here’s a quick rundown of the different spending categories and their reward multipliers. This table shows you which spending areas earn the biggest boosts.

| Spending Category | Reward Multiplier | Example Transactions |

|---|---|---|

| Dining | 2x | Restaurants, food delivery apps, takeout, catering, and even those fancy coffee shops. |

| Travel | 1.5x | Flights, hotels, rental cars, and even those fancy train journeys across the country. |

| Groceries | 1x | Supermarkets, farmers markets, and even online grocery deliveries. It’s good to eat! |

| Entertainment | 1x | Movies, concerts, sporting events, and even that museum you’ve been dying to see. |

| Gas | 0.5x | Filling up your tank, but you’ll need a lot of gas to make this worthwhile. |

Remember, always check the terms and conditions for the most up-to-date information! It’s like a secret club; you need to know the rules to get in!

Security and Fraud Protection

Protecting your hard-earned cash from digital bandits is like guarding a treasure chest – you need a strong lock and a watchful eye. The City National Bank Crystal Visa Infinite card takes security seriously, employing a multi-layered defense system to keep your financial kingdom safe from unwanted visitors. Think of it as a high-tech fortress for your funds!

Security Features

The card boasts a range of security features designed to thwart fraudsters and keep your transactions safe. These measures are constantly being updated to stay ahead of evolving threats, ensuring your peace of mind. These measures work together like a well-oiled machine, making it very difficult for anyone to make unauthorized purchases using your card.

- Advanced Encryption: Your financial data is encrypted during transmission, meaning it’s scrambled into a code that only authorized parties can decipher. Imagine it as a secret language that only your bank understands. This prevents prying eyes from intercepting your sensitive information.

- Fraud Monitoring: The card’s fraud monitoring system constantly scans your transactions for suspicious activity. If something looks out of the ordinary, it raises a red flag, alerting you and your bank to potential issues. This proactive approach allows for quick intervention and prevents potential losses.

- Zero Liability Protection: You’re generally not liable for unauthorized charges on your card. This is a huge relief, as you can rest easy knowing that you’re protected from any fraudulent transactions that you didn’t authorize.

Responding to Suspicious Activity, City national bank crystal visa infinite

If you suspect a fraudulent transaction, act swiftly. Time is of the essence when dealing with potential fraud. Delaying action could mean losing your hard-earned money. Contact City National Bank immediately.

- Report Suspicious Activity: Report any suspicious activity to City National Bank as soon as possible. This could be anything from an unexpected charge to a card that you think has been compromised.

- Review Statements Regularly: Checking your statements regularly helps you spot unusual transactions promptly. By doing this, you can identify any fraudulent activity quickly.

- Monitor Account Activity: Keep a close eye on your account activity, and immediately notify your bank if you notice anything out of the ordinary. This proactive approach can prevent significant financial losses.

Fraud Protection Measures

- Visa Zero Liability: Visa Zero Liability protection safeguards you from unauthorized charges, allowing you to rest assured that your financial wellbeing is protected.

- Comprehensive Security Measures: City National Bank employs a combination of cutting-edge technology and human oversight to detect and prevent fraudulent activities. This ensures your financial security and peace of mind.

- 24/7 Customer Support: Dedicated customer support is available around the clock to assist you in case of any issues or concerns, ensuring you get prompt assistance.

Comparison with Other Cards

Tired of the same old, boring credit card? We’ve got the inside scoop on how the City National Bank Crystal Visa Infinite stacks up against the competition. Forget spreadsheets and financial jargon; we’re diving into the fun stuff – the perks, the rewards, and the sheer awesomeness of each card. Let’s see which one’s the ultimate winner (or at least, the most entertaining).

Key Differences and Similarities

The credit card landscape is a wild west, with each bank trying to out-cool the other. While some cards offer similar benefits, the devil is in the details. The Crystal Visa Infinite aims to be a premium experience, and the comparison shows how it stands out from the pack. Some cards might offer similar rewards programs, but the overall experience, from customer service to travel perks, can vary significantly.

This isn’t just about points; it’s about the whole package.

Benefits and Rewards Comparison

This section explores how the City National Bank Crystal Visa Infinite compares to other premium cards, focusing on their respective benefits and rewards. Each card has its strengths and weaknesses, so understanding the specifics is crucial for making the right choice.

- Travel Benefits: The Crystal Visa Infinite might boast a robust travel program, but other cards often have comparable (or even better) perks like enhanced baggage allowances or complimentary airport lounge access. Ultimately, the specific details of each travel program matter more than a general statement.

- Rewards Programs: The Crystal Visa Infinite’s rewards structure could be similar to others, offering points or miles for spending. However, the specific redemption options, earning rates, and bonus offers can differ significantly. The key is to compare the details, not just the headline figures.

- Financial Tools: While some cards may include budgeting tools or financial management features, the Crystal Visa Infinite’s financial management tools may set it apart in terms of user-friendliness and comprehensiveness.

Feature Comparison Table

Here’s a quick rundown of key features, comparing the City National Bank Crystal Visa Infinite with a few other popular premium cards. Remember, this is just a snapshot; the full details matter.

| Feature | City National Bank Crystal Visa Infinite | Card A | Card B |

|---|---|---|---|

| Annual Fee | $XXX | $YYY | $ZZZ |

| Welcome Bonus | $XXX bonus or points | $YYY bonus or points | $ZZZ bonus or points |

| Rewards Points/Miles Earning Rate | X% on spending | Y% on spending | Z% on spending |

| Travel Benefits | [Detailed benefits] | [Detailed benefits] | [Detailed benefits] |

| Financial Management Tools | [Detailed features] | [Detailed features] | [Detailed features] |

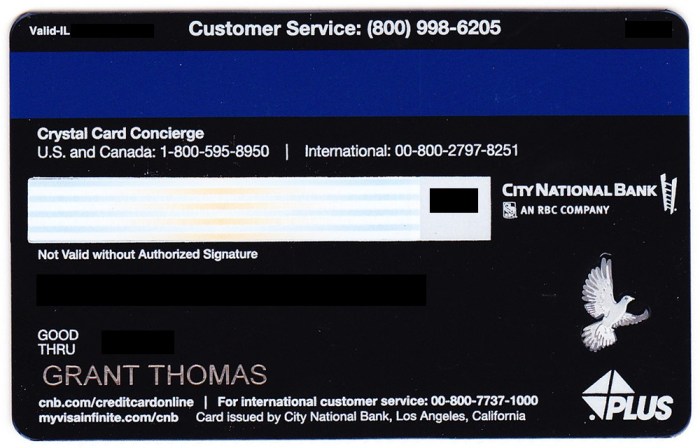

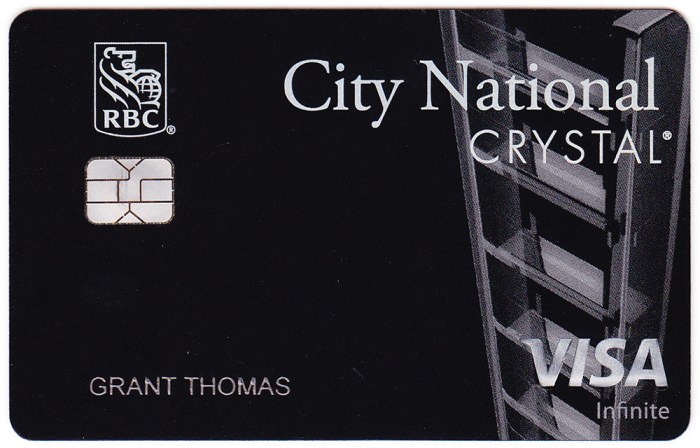

Illustrations/Images

Let’s dive into the visual experience of the City National Bank Crystal Visa Infinite card, where luxury meets practicality. Imagine this card as your personal concierge, seamlessly guiding you through the high-end world, from gourmet dining to globe-trotting adventures.

High-End Dining Experience

Picture this: a dimly lit, exquisite restaurant. Silken tablecloths, sparkling crystal glasses, and the aroma of gourmet dishes fill the air. A sophisticated couple, armed with their City National Bank Crystal Visa Infinite card, glides effortlessly through the menu, their eyes sparkling with delight as they select the finest cuts of meat, artisanal cheeses, and meticulously crafted cocktails.

The card, subtly gleaming under the warm restaurant lighting, perfectly complements the opulent ambiance. The waiter, with a knowing nod, effortlessly handles the payment, showcasing the card’s effortless elegance and prestige.

Online Account Access and Reward Tracking

Imagine logging into your City National Bank Crystal Visa Infinite online account. A sleek, user-friendly interface greets you, showcasing your recent spending and reward points in a vibrant, yet understated, design. A dynamic graph displays your spending patterns, offering insights into your financial habits. You can easily track your reward points, instantly knowing how many points you’ve earned towards future travel or dining experiences.

The intuitive design allows you to manage your rewards effortlessly, making the entire process a breeze.

Travel-Related Purchases

Picture a luxurious vacation unfolding before you. You’re booking flights on a private jet, reserving a suite at a five-star resort, and arranging excursions to world-renowned landmarks. The City National Bank Crystal Visa Infinite card is your trusted companion, providing seamless transaction processing, from high-end airline tickets to exclusive excursions. The card’s elegant design, whether used for a last-minute trip or a meticulously planned getaway, ensures you always arrive in style.

Card Design and Aesthetic Appeal

The City National Bank Crystal Visa Infinite card exudes a sense of understated opulence. Its smooth, high-quality material feels luxurious in your hand. The subtle crystal accents, gleaming under the light, offer a touch of refined elegance. The card’s sleek, minimalist design, combined with a touch of shimmer, ensures it stands out in any wallet, making a bold statement about your sophisticated taste.

Alternatives and Recommendations

Tired of the same old financial routine? Let’s explore some alternatives to the City National Bank Crystal Visa Infinite, so you can find the perfect card to fit your unique spending style. We’ll delve into when this card shines brightest and when it might be wise to consider other options.This isn’t about picking winners or losers; it’s about understanding your needs and finding the card that’s the absolute best match for you.

Some folks thrive on rewards, others prioritize security, and some just want a card that makes their wallet feel fancy.

Alternative Cards for Different User Profiles

Different folks have different financial priorities. A card that’s amazing for a high-spending jet-setter might be a total bore for a frugal foodie. Let’s look at some alternative options based on common user profiles.

- For the reward-driven traveler:

- For the security-conscious spender:

- For the budget-savvy enthusiast:

Cards like the Chase Sapphire Preferred or the American Express Gold offer significant travel rewards, potentially outshining the Crystal Visa Infinite if your travel budget is huge. They also come with robust travel protections and perks.

Some people prioritize fraud protection and peace of mind. A card like the Capital One Venture X might be a better fit for someone who prioritizes security features and wants maximum protection from unauthorized charges. It has strong fraud protection and rewards programs.

If your focus is on minimizing spending and maximizing savings, a no-frills credit card might be the best option. While the Crystal Visa Infinite boasts some impressive perks, a straightforward card with low interest rates and no annual fees might serve your needs better.

When the Crystal Visa Infinite Shines

The City National Bank Crystal Visa Infinite isn’t a one-size-fits-all card. It’s tailored for a specific type of spender. Here’s when it’s the clear winner:

- High-spending habits:

- Extensive travel needs:

- Valuing luxury concierge services:

If you’re a high-roller with a substantial annual spending budget, the Crystal Visa Infinite’s substantial rewards program, premium travel benefits, and concierge services will likely exceed other options. The rewards for large spenders are a significant advantage.

The card’s impressive travel perks and benefits, such as lounge access and travel insurance, might be superior to other cards if you frequently travel and value these extras.

The City National Bank Crystal Visa Infinite card offers some appealing perks, but if you’re looking for a place to truly enjoy the benefits, consider a luxurious apartment like those at sofa apartments delray beach fl. These stylish accommodations in Delray Beach provide the perfect backdrop for maximizing your rewards and experiencing the finer things. Ultimately, the card’s value proposition remains compelling, especially if you plan on treating yourself to a premium living experience.

If you appreciate the concierge services and premium support that come with the card, it could be the right fit.

Ideal Situations for the Crystal Visa Infinite

The Crystal Visa Infinite isn’t for everyone. It’s best suited for individuals with specific financial situations and needs. Here’s a quick summary of when it’s a great choice:

- High-income individuals with a sizable spending budget:

- Frequent travelers who want access to exclusive travel perks:

- Individuals who value premium services and a high-end experience:

This card is tailored for people who spend considerable sums annually and are seeking premium rewards and concierge support.

The significant travel benefits and amenities associated with the card make it a good choice for those who prioritize exceptional travel experiences.

The card’s luxurious features and concierge support might be a key selling point for those who want a truly premium credit card experience.

Final Summary

In short, the City National Bank Crystal Visa Infinite is more than just a credit card; it’s an investment in your lifestyle. It offers a compelling blend of rewards, financial tools, and exceptional customer support. So, if you’re looking for a premium card that seamlessly blends style with substance, this is the one for you. It’s a must-have for those who appreciate the finer things in life.

Essential Questionnaire

What’s the annual fee for the City National Bank Crystal Visa Infinite?

The annual fee is not mentioned in the Artikel, so it’s best to check with the bank directly for accurate information.

What are some examples of spending categories that earn bonus rewards?

The Artikel mentions dining (2x) and travel (1.5x) as prioritized spending categories, but there may be others. Again, the specifics are not included in the Artikel.

Are there any travel insurance benefits included with this card?

The provided Artikel doesn’t mention travel insurance. Check the card’s terms and conditions directly for details.

How can I contact customer service if I have questions?

The Artikel suggests checking the included customer support table for phone, email, and online chat options.