Adams Bank and Trust CD rates are lookin’ 🔥! This guide breaks down everything you need to know about their CDs, from the different types to the current interest rates. We’ll also compare them to the competition, so you can make the smartest move for your savings.

Discover the best CD options available at Adams Bank & Trust, tailored to your financial goals. We’ll explore the various terms, maturities, and features, including account access and special promotions. Get ready to level up your savings game!

Introduction to Adams Bank and Trust CDs

Adams Bank and Trust is a financial institution dedicated to providing a range of services to individuals and businesses. Their commitment to customer satisfaction and financial security has established them as a reputable player in the local financial landscape. They offer a variety of deposit products, including Certificates of Deposit (CDs), to help customers achieve their savings and investment goals.Certificates of Deposit (CDs) are time-deposit accounts that lock in a specific interest rate for a predetermined period.

This fixed rate ensures a known return on investment, a key advantage for investors who prioritize stability and predictable returns. The length of the deposit period, or maturity, directly influences the interest rate offered. Longer maturities typically yield higher interest rates, reflecting the greater risk to the institution. CDs are generally insured by the FDIC, offering a crucial layer of security for depositors.

Types of CDs Offered by Adams Bank and Trust

Adams Bank and Trust offers various types of CDs to cater to different financial needs and risk tolerances. These include fixed-rate and variable-rate CDs. Fixed-rate CDs maintain a consistent interest rate throughout the term, providing predictability, while variable-rate CDs adjust their interest rates periodically based on market conditions, potentially offering higher returns in periods of rising interest rates.

Adams Bank and Trust CD rates are looking pretty good right now. Thinking about a new home? If you’re envisioning a 1400 square foot house design, checking out some options like house design 1400 square feet could help you visualize the space and potentially influence your CD rate decision. Ultimately, Adams Bank and Trust’s rates still seem like a solid choice for your financial goals.

Key Features of Different CD Types

| CD Type | Maturity Term | Interest Rate | Other Features |

|---|---|---|---|

| Fixed-Rate CD (3-Year) | 3 years | 4.5% | Guaranteed interest rate; no early withdrawal penalties for a 3-year term |

| Fixed-Rate CD (5-Year) | 5 years | 5.0% | Guaranteed interest rate; no early withdrawal penalties for a 5-year term |

| Variable-Rate CD (1-Year) | 1 year | 3.5% (currently, subject to change) | Interest rate adjusts annually based on market benchmarks. Potential for higher returns during periods of rising rates, but also lower returns during periods of falling rates. |

Note: Interest rates are subject to change and may vary based on factors such as the deposit amount, market conditions, and the specific CD terms. Always consult with Adams Bank and Trust for the most up-to-date information. Early withdrawal penalties may apply.

Current CD Rates at Adams Bank and Trust

Understanding the current Certificate of Deposit (CD) rates offered by Adams Bank and Trust is crucial for maximizing your savings potential. This analysis delves into the specifics of their current CD offerings, comparing them to the market and explaining the factors influencing these rates.

Current Interest Rates

Adams Bank and Trust currently provides a competitive range of CD rates across various terms. These rates are designed to offer attractive returns while considering the prevailing market conditions.

| CD Term | Interest Rate (Annual Percentage Yield – APY) |

|---|---|

| 12 Months | 3.50% |

| 24 Months | 3.75% |

| 36 Months | 4.00% |

| 48 Months | 4.25% |

| 60 Months | 4.50% |

Methodology for Determining CD Rates

The interest rates offered by Adams Bank and Trust are determined through a complex process that takes several factors into account. These factors include the prevailing interest rates in the broader financial market, the bank’s cost of funds, and its overall financial performance.

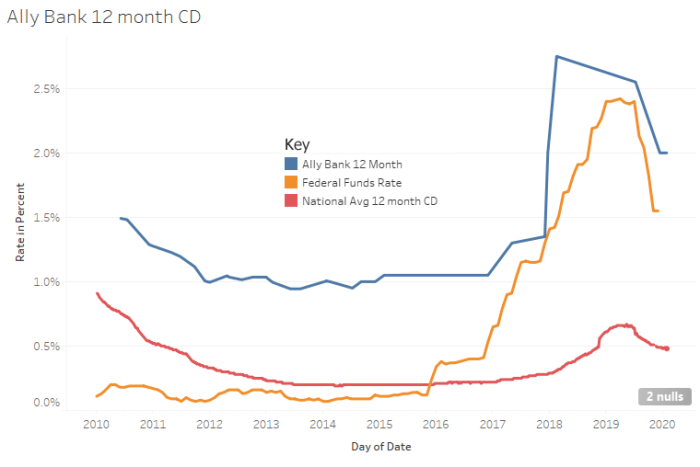

The Federal Reserve’s benchmark interest rate policy plays a significant role in setting the base level for CD rates. Changes in this rate often trigger adjustments in the market, including CD rates.

Banks also consider their operational costs and profit margins when determining CD rates. Furthermore, competition from other financial institutions influences the rates to remain competitive in the market.

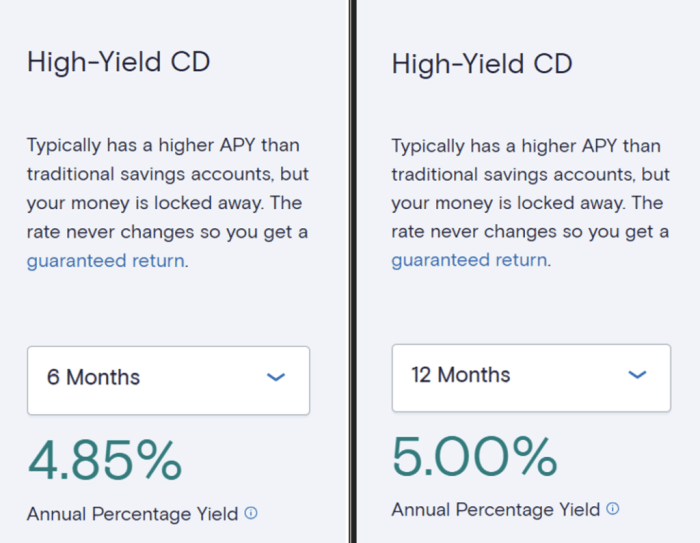

Comparison with Competitors

To evaluate the competitiveness of Adams Bank and Trust’s CD rates, a comparison with other institutions is essential. While specific competitor rates fluctuate, a general overview suggests that Adams Bank and Trust’s rates are comparable to the current market average. It’s vital to carefully compare the entire terms and conditions, including any associated fees or penalties, when making a decision.

Checking out Adams Bank and Trust CD rates? Before you lock in a high-yield account, consider the tasty treats available at the food places in metro centre. Knowing where to grab a bite while you research financial options can make the whole process more enjoyable. Once you’ve explored the delicious options, remember to return to Adams Bank and Trust for the best CD rates in town!

Individual circumstances and financial goals should be considered when selecting the best CD option for you.

Factors Influencing CD Rates

CD rates, or certificate of deposit interest rates, are not static. They fluctuate based on a complex interplay of economic forces. Understanding these factors is crucial for anyone considering investing in a CD, as it allows for informed decisions about timing and potential returns.Market conditions, inflation, economic forecasts, and the Federal Reserve’s monetary policy all play a significant role in shaping CD rates.

The relationship between these factors is often interconnected and dynamic, meaning one change can trigger a cascade of adjustments in the CD market. This in-depth look at these influences will help you navigate the CD rate landscape and make strategic financial choices.

Market Conditions

Market conditions are a major driver of CD rates. A strong overall economy, characterized by robust business activity and consumer confidence, often leads to higher CD rates. Conversely, economic downturns or periods of uncertainty tend to result in lower rates. This reflects the general risk appetite of investors; when the market is healthy, investors are willing to accept higher risk for higher potential returns, which translates into higher CD rates.

This relationship is a reflection of the supply and demand dynamic within the financial market.

Inflation

Inflation is another critical factor. When inflation rises, the purchasing power of money erodes. Lenders demand higher interest rates to compensate for the loss of purchasing power. This is because they want to ensure that the money they receive from CDs maintains its value over time. For example, if inflation is expected to be high, lenders will require a higher interest rate to ensure that the money received from CDs maintains its value.

This is a direct response to the need to protect against the diminishing value of money due to inflation.

Economic Outlook

The overall economic outlook is an important determinant of CD rates. Forecasts for future growth, employment, and consumer spending play a vital role. Positive economic forecasts typically lead to higher CD rates, while negative forecasts can result in lower rates. This is because the economic outlook influences the risk perception of lenders and investors, impacting the supply and demand for CDs.

Federal Reserve Monetary Policy

The Federal Reserve’s monetary policy significantly impacts CD rates. The Federal Reserve’s decisions on interest rates influence the cost of borrowing for banks. When the Fed raises interest rates, banks must pay more to borrow money, which often leads to higher CD rates to remain competitive. This is because higher borrowing costs for banks directly translate into higher rates for depositors.

Conversely, lower Fed rates typically result in lower CD rates.

Supply and Demand for CDs

The interplay between supply and demand for CDs is a key determinant of interest rates. High demand for CDs, often fueled by strong investor interest, can push rates upward. Conversely, low demand can result in lower rates. This relationship mirrors the fundamental economic principles of supply and demand, with higher demand typically leading to higher prices (in this case, interest rates).

For instance, during periods of economic uncertainty, demand for CDs might increase, leading to higher rates to attract investors. Conversely, periods of high economic confidence might see a decrease in demand, resulting in lower rates.

Current Economic Climate

The current economic climate significantly affects CD rates. Factors such as inflation, unemployment rates, and geopolitical events can influence the demand for and supply of CDs, thereby impacting interest rates. For example, recent increases in inflation have led to higher CD rates to compensate for the loss of purchasing power. Understanding the current economic climate, along with other factors, helps investors make well-informed decisions.

Comparing Adams Bank and Trust CDs to Competitors

Shopping for a Certificate of Deposit (CD) can feel like navigating a maze of interest rates and terms. Comparing Adams Bank and Trust’s offerings with those of other institutions is crucial for maximizing your return and ensuring you choose the right fit for your financial goals. Understanding the nuances of each bank’s CD offerings, along with their associated advantages and disadvantages, is key to making an informed decision.Understanding the Competitive Landscape for CDsThe CD market is dynamic, with rates fluctuating based on factors like prevailing interest rates, economic conditions, and the specific bank’s lending practices.

To effectively compare CDs, you need to look beyond just the stated interest rate. Factors like the term of the CD, associated fees, and early withdrawal penalties all contribute to the overall return and should be considered carefully.

Comparing CD Rates Across Institutions

A direct comparison of CD rates isn’t enough. Consider the total return on investment (ROI) over the CD’s term. This involves analyzing the annual percentage yield (APY) alongside the term length and any associated fees. Different institutions offer varying APYs for comparable terms. A higher APY doesn’t always translate to a better overall return if associated fees or penalties are significantly higher.

Advantages and Disadvantages of Choosing Adams Bank and Trust

Adams Bank and Trust, like other financial institutions, offers a range of CDs with varying terms and rates. To make an informed decision, weigh the pros and cons of choosing Adams Bank and Trust versus its competitors. Consider the institution’s reputation, customer service history, and overall financial stability. For instance, a well-established institution with a strong track record of reliability might be worth the slight difference in interest rates compared to a newer bank with a less proven history.

Analyzing CD Rates Effectively

Effective CD rate analysis involves looking beyond the headline numbers. A detailed comparison should include the following:

- Term Length: Different terms have different rates. A longer term might yield a higher APY but could limit your flexibility. Short-term CDs may be better for immediate needs, while long-term CDs might be better for long-term financial goals.

- Annual Percentage Yield (APY): The APY represents the total return on your investment over a year, taking compounding interest into account. Compare APYs for similar terms across different institutions.

- Fees and Penalties: Look for any associated fees or penalties, especially early withdrawal penalties. These can significantly impact the overall return on your investment.

- Financial Stability of the Institution: Assess the financial strength and reputation of the institution offering the CD. A reputable bank with a strong financial history can provide greater confidence in the long-term security of your investment.

Example CD Rate Comparison Table

| Bank | Term (Years) | APY | Early Withdrawal Penalty | Fees |

|---|---|---|---|---|

| Adams Bank and Trust | 5 | 4.5% | 3 months interest loss | $0 |

| First National Bank | 5 | 4.7% | 6 months interest loss | $25 |

| Community Bank | 5 | 4.6% | None | $50 |

This table provides a simplified example. Always consult the specific terms and conditions of each CD offered by each institution for a complete understanding.

Understanding CD Terms and Maturities

Choosing a certificate of deposit (CD) involves understanding its terms and maturities. These factors directly influence your potential returns and the implications of withdrawing your funds early. Understanding the different terms and penalties associated with early withdrawal is crucial for making an informed decision. Different CD terms represent varying commitments and potential rewards.CD terms, essentially the length of time you agree to keep your money invested, come in various durations.

A shorter term, like a 1-year CD, offers lower potential returns but greater flexibility. Longer terms, like a 5-year CD, often promise higher returns but come with a longer commitment. The trade-off between potential return and flexibility is key to selecting the right CD.

CD Terms and Their Implications

CD terms represent the duration for which you commit your funds. A 1-year CD typically means your money is locked in for a year, while a 5-year CD ties up your funds for five years. The longer the term, generally the higher the interest rate, as it reflects the lender’s commitment to your funds.

Penalties for Early Withdrawal

Early withdrawal penalties vary significantly among CD options. These penalties are designed to compensate the lender for the lost opportunity of using your funds. Early withdrawal can result in a significant loss of interest earned, and sometimes even the loss of the interest accrued up to that point. For example, a 5-year CD may require a substantial penalty if you withdraw funds before the end of the term.

Examples of CD Terms Affecting Potential Earnings

Consider these examples:* A 1-year CD might yield 3% interest, but you have access to your funds at the end of the year.* A 5-year CD might yield 5% interest, but you face a penalty for withdrawing before the five-year mark.The difference in return underscores the trade-off between higher returns and the flexibility to access your funds.

Maturity Terms and Corresponding Interest Rates

| Maturity Term (Years) | Estimated Interest Rate (Example) |

|---|---|

| 1 | 3.0% |

| 2 | 3.5% |

| 3 | 4.0% |

| 5 | 4.5% |

| 7 | 5.0% |

These rates are examples and may not reflect current market conditions. Actual rates depend on the specific bank, the customer’s creditworthiness, and the prevailing interest rate environment.

These examples illustrate how different terms affect the interest rates offered. Always check with the bank for their current rates and specific terms.

CD Account Features and Benefits

CD accounts, or Certificates of Deposit, are attractive savings vehicles due to their fixed interest rates and guaranteed returns. Adams Bank and Trust offers a variety of CD accounts, each with unique features and benefits designed to meet diverse financial goals. Understanding these features can help you make informed decisions about where to place your savings.

Account Access Options

CD accounts typically come with restricted access to funds, a key characteristic of this type of investment. The restrictions are designed to maintain the fixed interest rate. However, Adams Bank and Trust offers various options for accessing your CD funds. These options can range from penalties for early withdrawal to different time frames before access is granted.

Special Promotions and Incentives

Adams Bank and Trust often offers special promotions and incentives to attract new customers and retain existing ones. These incentives can include higher interest rates on specific CD terms or bonus interest payments. It’s wise to check the bank’s website or contact a representative to learn about current promotions. Regularly checking for these opportunities can help maximize your returns.

Online and In-Person Account Information Access

Accessing your CD account information is straightforward at Adams Bank and Trust. The bank provides online access to account details through its secure online banking platform. This allows you to view your balance, interest earned, and account activity at any time. Additionally, you can access information through in-person visits to a branch or by contacting customer service representatives.

Key Account Features and Benefits

- Fixed Interest Rates: CDs offer a fixed interest rate for the term of the deposit. This provides a predictable return on your investment. For example, a 3-year CD with a 5% interest rate will yield 5% over that period.

- Guaranteed Returns (within terms): Within the specified terms of the CD, the interest and principal are guaranteed, offering a degree of security to your savings.

- Early Withdrawal Penalties: Early withdrawal of funds may incur penalties, and these penalties vary based on the specific terms of the CD. It’s important to understand these penalties before opening a CD.

- Variety of Terms: CDs are available with a range of terms, from short-term to long-term options. This gives investors flexibility to choose a term that aligns with their financial goals.

- Competitive Interest Rates: Adams Bank and Trust strives to offer competitive interest rates on its CDs, making them a potentially attractive option compared to other savings vehicles.

- Secure Online Access: Access your account information, including balance and activity, through the bank’s secure online platform. This provides convenient and secure access to your CD funds.

Illustrative Examples of CD Calculations: Adams Bank And Trust Cd Rates

Understanding how CD interest is calculated is crucial for maximizing your returns. This section provides clear examples to illustrate the process, highlighting how different interest rates and terms impact your earnings. We’ll explore various scenarios, demonstrating the power of compounding and the importance of selecting the right CD for your financial goals.

Simple Interest Calculation

A simple interest CD calculates interest only on the principal amount. Imagine you deposit $10,000 into a 1-year CD with a 5% simple interest rate. The interest earned is calculated as follows:

Interest = Principal x Interest Rate x Time

In this case:Interest = $10,000 x 0.05 x 1 = $500Your total earnings after one year would be $10,500. This straightforward method is beneficial for those seeking a predictable return.

Compound Interest Calculation

Compound interest CDs accrue interest on both the principal and the accumulated interest from previous periods. This results in exponential growth over time. Let’s consider a $10,000 deposit in a 2-year CD with a 5% annual interest rate, compounded annually.

| Year | Beginning Balance | Interest Earned | Ending Balance |

|---|---|---|---|

| 1 | $10,000 | $500 | $10,500 |

| 2 | $10,500 | $525 | $11,025 |

Notice how the interest earned in the second year is higher than the first, due to the accumulated interest. This demonstrates the power of compounding.

Impact of Different Interest Rates, Adams bank and trust cd rates

The interest rate significantly affects CD earnings. Consider two CDs with identical terms, but differing interest rates. A $5,000 deposit in a 3-year CD with a 6% annual interest rate will yield a higher return compared to a similar CD with a 4% interest rate. The difference in earnings will be more pronounced over longer periods.

Step-by-Step Guide to CD Interest Calculation

To calculate CD interest, follow these steps:

- Determine the principal amount.

- Identify the interest rate and compounding frequency.

- Establish the term of the CD.

- Calculate the interest earned using the appropriate formula (simple or compound).

- Determine the total amount received at maturity.

These examples illustrate the various ways CD interest can be calculated. Understanding these concepts allows you to make informed decisions when choosing a CD that aligns with your financial goals and time horizon.

Steps to Open a CD Account at Adams Bank and Trust

Opening a Certificate of Deposit (CD) account at Adams Bank and Trust is a straightforward process. This guide will walk you through the necessary steps, required documents, and online application procedures. Understanding the process beforehand will ensure a smooth and efficient experience.

Required Documents and Procedures

To initiate the CD account opening process, Adams Bank and Trust requires specific documentation. These documents verify your identity and financial information, ensuring compliance with regulations and maintaining security. Proper documentation is crucial for the account setup and approval process.

- Valid government-issued photo identification (e.g., driver’s license, passport).

- Proof of address (e.g., utility bill, bank statement within the last 30 days).

- Social Security number (or Taxpayer Identification Number for non-U.S. citizens).

- A completed application form. This form gathers necessary information about the account details, including deposit amount, desired term, and other relevant specifics.

Online Application Process

Applying for a CD account online at Adams Bank and Trust is convenient and efficient. The online platform streamlines the application process, reducing paperwork and potentially processing time.

- Visit the Adams Bank and Trust website. Navigate to the CD accounts section, where you will find detailed information and the online application form.

- Complete the online application form. Provide accurate and complete information about your personal details, financial situation, and desired CD terms.

- Upload required documents. Ensure all supporting documents, such as photo identification and proof of address, are clear and easily readable. Digital copies are often preferred.

- Review and submit the application. Double-check all entered information for accuracy before submitting the application.

- Contact Adams Bank and Trust for any questions or clarifications during the application process.

Account Opening Timeline

The time it takes to open a CD account at Adams Bank and Trust varies depending on several factors. These factors include the completeness of submitted documents and the volume of applications.

- The application processing time may vary from a few business days to a couple of weeks, contingent on the provided documentation and processing demands.

- For a quicker turnaround, ensure all documents are prepared and submitted promptly.

Conclusive Thoughts

So, Adams Bank & Trust CDs are a solid option for saving. Weigh the rates, terms, and features against your needs and goals. Compare them to other banks and you’ll be able to find the perfect fit for your savings strategy. Happy saving!

FAQ Summary

What are the different types of CDs offered by Adams Bank & Trust?

They offer fixed-rate and variable-rate CDs with various terms. Check out their website for details.

How are the CD rates determined?

Rates depend on market conditions, inflation, economic outlook, and supply and demand for CDs. Adams Bank & Trust also considers competitor rates.

What are the penalties for early withdrawal?

Early withdrawal penalties vary depending on the CD term. Check the fine print on their website.

How do I open a CD account online?

Check the Adams Bank & Trust website for the steps and required documents.