Sample letter of bank account closure: A comprehensive guide walks you through the process of closing your bank account, providing a detailed explanation of the necessary steps, documents, and considerations. This includes various situations, from simple account closures to those with outstanding balances, minors, or joint accounts.

This guide provides a clear Artikel of the typical procedures, necessary documentation, and legal aspects to ensure a smooth and compliant account closure. It also explores alternatives to closing, like suspending or transferring funds.

Understanding Account Closure Procedures

Account closure, a fundamental banking transaction, necessitates adherence to specific procedures to ensure a smooth and legally sound process. This involves meticulous documentation and communication to avoid potential complications for both the account holder and the financial institution. Understanding these procedures is crucial for a seamless transition and the avoidance of unforeseen issues.The account closure process varies depending on the type of account and the financial institution.

This analysis will detail the typical steps, necessary documentation, and potential consequences of deviating from established protocols. This comprehensive overview is intended to empower individuals with the knowledge required to navigate this transaction with confidence and accuracy.

Account Closure Steps

The standard account closure process generally involves several key steps. Firstly, the account holder must initiate the closure request. This can be done via a formal written request, or, in some cases, electronically through online banking portals. Secondly, the bank will verify the account holder’s identity and, in certain circumstances, will request additional documentation to validate the closure request.

Following verification, the bank will proceed to finalize the account closure. This usually involves closing the account, updating relevant records, and, in some cases, notifying relevant parties. Finally, the bank will provide the account holder with confirmation of the account closure and, where applicable, return any outstanding funds.

Required Documents for Account Closure

Proper documentation is critical to a successful account closure. These documents serve as proof of identity and authority, ensuring the closure request is legitimate. Account holders must provide identification documents such as government-issued photo identification (e.g., driver’s license, passport). Proof of address is also frequently required. Specific documents may vary based on the type of account and the bank’s policies.

Account Closure Procedures Across Different Bank Types

Account closure procedures exhibit some variations between retail and commercial banks. Retail banks, catering to individual customers, typically have simplified procedures, while commercial banks, serving businesses and corporations, often have more complex procedures due to the potential for larger account balances and more intricate transaction histories. The level of documentation and the time frame for closure may differ based on the account’s size and the specific circumstances.

Potential Consequences of Improper Procedure

Failure to adhere to the established account closure procedures may lead to complications and potential financial ramifications. These consequences could include delays in the account closure, issues with access to funds, or, in severe cases, disputes and legal action. Thorough understanding and adherence to the prescribed protocols minimize the risk of such unfavorable outcomes.

A sample letter for closing a bank account is generally straightforward, outlining the account details and your request. If you’re looking for a template specific to United Community Bank Bakersville NC, you can find helpful resources on their website at united community bank bakersville nc. Be sure to carefully review the bank’s specific requirements for account closure before sending your letter.

Importance of Documents in Account Closure

The significance of documents in the account closure process cannot be overstated. Proper documentation ensures the closure is handled correctly, protecting both the account holder and the bank. These documents verify the account holder’s identity and authority to close the account.

| Document Type | Description | Importance |

|---|---|---|

| Government-Issued Photo ID | Proof of identity, such as a driver’s license or passport. | Essential for verifying the account holder’s identity and preventing unauthorized closures. |

| Proof of Address | Utility bill, lease agreement, or similar documents. | Verifies the account holder’s current address, which is crucial for accurate record-keeping. |

| Account Statement | Document detailing the account’s balance and transactions. | Necessary for verifying the account balance and ensuring accuracy in the closure process. |

| Closure Request Form | A formal request to close the account. | Formalizes the account closure process, outlining the account holder’s intent to close the account. |

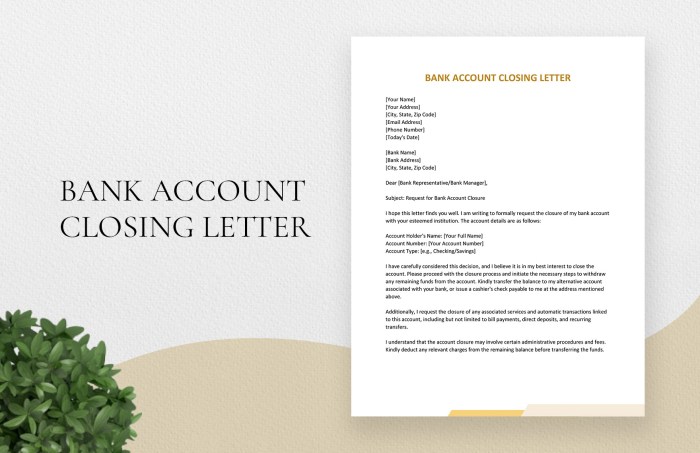

Drafting a Sample Letter

A formal letter requesting bank account closure requires meticulous attention to detail and adherence to specific formatting guidelines. This process ensures a smooth and efficient account closure procedure, minimizing potential issues and maximizing clarity for both the account holder and the bank.

Need a sample letter for closing your bank account? You might want to check out the delicious options on the Boulder Creek Pizza Pub menu first, boulder creek pizza pub menu , before you finalize the closure. Once you’ve made your food selections, you can then draft the perfect bank account closure letter.

Account Details Section

This section is crucial for the bank to identify the correct account. Accurate and complete information is paramount to avoid delays or misidentification. Failure to provide precise details may result in the bank’s inability to process the closure request.

- Account Number: Explicitly state the account number as it appears on the account statements or bank documentation. Any discrepancies may lead to the rejection of the request.

- Account Type: Clearly specify the type of account being closed (e.g., checking, savings, joint account). This prevents ambiguity and ensures the correct account is targeted for closure.

- Account Holder(s): List all account holders with their full legal names, as they appear on the account records. In cases of joint accounts, ensure all parties authorize the closure request.

- Date of Account Opening: Providing the date of account opening allows for verification of account duration and assists in evaluating potential account fees or penalties.

Reason for Closure Section, Sample letter of bank account closure

Clearly stating the reason for account closure is essential. A brief and concise explanation is sufficient.

- Concise Explanation: Avoid overly complex or lengthy explanations. A simple and direct statement is ideal. Examples include: “Moving to a new financial institution,” “No longer requiring the account,” or “Closing for personal reasons.”

- Avoidance of Vague Language: Vague reasons for closure might complicate the process. Using specific and concrete language is essential.

Desired Actions Section

This section Artikels the specific actions requested from the bank. Explicitly stating the desired outcomes avoids potential misunderstandings.

- Closure Confirmation: Request a formal confirmation of the account closure. This acknowledgement is a critical step to verify that the closure request has been successfully received and processed.

- Closure Timeline: If a specific timeline for closure is desired, state the timeframe explicitly. This helps manage expectations and ensures the closure is completed within the desired timeframe.

- Closing Balance Information: Request the closing balance statement and the method for its delivery (e.g., mailed, electronically via online banking). This ensures the account holder receives the accurate closing balance information.

Language and Tone

The language employed in the letter should be formal and professional. Avoid informal language, slang, or emotional language. Maintaining a respectful tone is essential for a smooth interaction.

- Formal Tone: A professional tone is expected in formal communication with financial institutions. Using polite and respectful language ensures a positive interaction.

- Clear and Concise Language: Avoid ambiguity or jargon. The language should be easily understandable by the bank’s personnel.

Letter Structure

The structure of the letter should be organized logically. Clear headings and subheadings are highly recommended.

- Header: Include the date, sender’s address, recipient’s address, and subject line. A clear subject line (e.g., “Request for Account Closure”) is vital for efficient processing.

- Salutation: Address the letter to the appropriate department or individual.

- Body: Present the account details, reason for closure, and desired actions in a structured manner.

- Closing: Use a formal closing (e.g., “Sincerely,” “Respectfully,”). Include the sender’s typed name and signature.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Bank Name]

[Bank Address]Subject: Request for Account Closure – [Your Account Number]

Dear [Bank Contact Person/Department],

This letter formally requests the closure of my account, [Account Type] account number [Account Number]. I am the sole account holder. The date of account opening is [Date].

I am closing this account due to moving to a new financial institution. Please provide a confirmation of the account closure and the closing balance statement. I would like the statement delivered electronically to [Email Address].

Sincerely,

[Your Typed Name]

[Your Signature]

Addressing Specific Situations

Account closure procedures necessitate careful consideration of unique circumstances. This section details specific situations requiring tailored approaches to ensure a smooth and compliant closure process. Proper handling of these cases prevents potential issues and ensures the bank upholds its obligations to all account holders.

Joint Account Closure

Joint accounts require the agreement of all parties involved for closure. Failure to obtain consent from all account holders may lead to complications and potential legal issues. Documentation of the mutual agreement is crucial for the closure process. This may involve a joint letter signed by all account holders or a certified copy of a written agreement.

Minor’s Account Closure

Closing a minor’s account necessitates specific considerations. Generally, the account holder must be a legal guardian or a parent with appropriate legal documentation. Banks are obligated to verify the identity and authority of the individual requesting the closure. A copy of the guardian’s identification and a court order, if applicable, are usually required. Strict adherence to these requirements safeguards the interests of the minor.

Accounts with Outstanding Balances or Pending Transactions

Accounts with outstanding balances or pending transactions necessitate a more involved closure process. The bank must ensure all outstanding amounts are resolved before closing the account. This may involve clearing any checks, debiting fees, or processing outstanding transactions. Thorough communication with the account holder regarding outstanding amounts and pending transactions is essential to avoid future disputes.

Situations Requiring Additional Documentation

Certain circumstances necessitate additional documentation beyond standard account closure procedures. This is crucial to ensure the accuracy and legitimacy of the closure request.

| Situation | Required Actions | Additional Considerations |

|---|---|---|

| Joint Account Closure with Disagreement | Seek legal counsel to determine appropriate next steps. The bank may need to consult legal experts to ensure a resolution that protects all parties involved. | Potential legal disputes or court intervention may be necessary. |

| Minor’s Account Closure with no Guardian | Contact relevant authorities (e.g., child protective services). This is necessary to ensure the minor’s best interests are protected and the account closure is done in accordance with legal requirements. | The closure process may be significantly delayed or require the involvement of external agencies. |

| Account with Unresolved Disputes or Claims | Engage in mediation or arbitration, if necessary. This may involve seeking an independent third party to resolve disputes and ensure all parties are satisfied with the outcome. | The closure may be delayed until the dispute is resolved. Documentation of the dispute resolution process is critical. |

| Account with Suspicious Activity | Report the suspicious activity to the relevant authorities (e.g., law enforcement, financial regulatory bodies). This is crucial to prevent fraud and protect the bank and account holder from potential losses. | The closure process may be delayed or suspended while authorities investigate the situation. |

Legal and Regulatory Considerations: Sample Letter Of Bank Account Closure

Bank account closure, while seemingly straightforward, is subject to a complex web of legal and regulatory requirements. These regulations are designed to protect both the bank and the account holder, ensuring a fair and transparent process. Failure to comply with these regulations can lead to significant penalties for both parties.The legal framework governing account closure varies significantly across jurisdictions.

This necessitates a nuanced understanding of the specific regulations applicable in each region. This section will delve into the legal requirements, potential penalties for non-compliance, and relevant regulatory guidelines that may impact the account closure process. A comparative analysis of legal frameworks across different countries will be presented, highlighting key differences and similarities.

Legal Requirements Surrounding Account Closure

Account closure procedures are typically governed by banking regulations and consumer protection laws. These regulations dictate the notice periods required by the bank, the documentation needed by the account holder, and the steps involved in verifying the account holder’s identity. Banks must adhere to strict protocols to prevent fraud and ensure the accuracy of account information. This includes procedures for verifying the account holder’s identity and ensuring the account closure is authorized by the correct party.

Relevant Regulations and Guidelines

Various regulations and guidelines may influence the account closure process. These include anti-money laundering (AML) regulations, which require banks to monitor and report suspicious transactions, and data privacy regulations, which dictate how personal data is handled. Compliance with these regulations is critical for both the bank and the account holder to avoid potential legal repercussions.

Potential Penalties for Non-Compliance

Non-compliance with legal requirements can result in severe penalties for both the bank and the account holder. Banks that fail to adhere to proper account closure procedures may face fines, regulatory sanctions, and reputational damage. Account holders who fail to provide accurate information or follow proper procedures might be subject to legal action, including potential penalties for fraud or misrepresentation.

Specific Legal Considerations by Country/Region

Legal considerations for account closure vary significantly depending on the jurisdiction. Different countries have different laws regarding consumer rights, banking practices, and the handling of financial data. The specifics of account closure procedures may include requirements for dispute resolution mechanisms, timelines for account closure, and the handling of any outstanding balances or fees.

Comparison of Legal Requirements Across Countries

| Country/Region | Notice Period (Days) | Documentation Required | Dispute Resolution Mechanisms | Penalties for Non-Compliance |

|---|---|---|---|---|

| United States | Typically 10-14 days | Government-issued ID, proof of address | Small claims court, arbitration | Fines, regulatory sanctions |

| European Union | Variable, depending on specific regulations | Government-issued ID, proof of address, potentially additional documents | European courts, national arbitration bodies | Fines, regulatory sanctions, potentially civil actions |

| United Kingdom | Typically 14 days | Government-issued ID, proof of address | Small claims court, arbitration | Fines, regulatory sanctions |

This table provides a simplified overview and does not encompass all nuances of the legal requirements in each country. Specific regulations may vary based on individual bank policies and circumstances.

Alternatives to Closure

Account closure, while a legitimate option, may not always be the optimal solution for managing financial resources. Alternative strategies, such as temporary suspensions, fund transfers, and account consolidations, can often address specific needs without permanently severing ties with the financial institution. These alternatives can be more efficient and less disruptive to overall financial management.

Temporary Account Suspension

Implementing a temporary suspension, often referred to as “freezing” an account, can be a practical approach to temporarily restrict access to funds. This allows for a period of inactivity without the formal action of closure. The duration of the suspension and associated fees, if any, are typically Artikeld in the bank’s terms and conditions. This measure can be particularly useful during periods of travel or when managing accounts for dependents.

The account remains active but is unavailable for transactions during the specified period.

Fund Transfer Procedures

Transferring funds to another account is a common and often preferred alternative to closure. This allows for seamless movement of funds, ensuring continuity of financial operations. Banks typically offer various transfer methods, including online platforms, phone banking, and in-person transactions. The transfer process often involves providing account details, including the recipient account number and routing information. This option is frequently used for consolidating funds or redirecting payments.

Account Consolidation Strategies

Consolidating multiple accounts into a single, primary account can simplify financial management and reduce administrative overhead. This approach streamlines transactions and facilitates a more comprehensive overview of financial holdings. Banks often offer consolidation services that involve transferring funds and merging account information. This option is especially beneficial for individuals with multiple accounts for different purposes, enabling a more organized financial structure.

Other Potential Alternatives

Other potential alternatives include modifying account types or services. A change in account type, for example, may suit a customer’s changing financial needs. Furthermore, modifications to account services, such as adjusting fees or interest rates, could potentially provide more favorable terms. Such options should be explored if they align with the customer’s financial goals and preferences.

Comparison of Closure and Alternatives

| Feature | Account Closure | Temporary Suspension | Fund Transfer | Account Consolidation |

|---|---|---|---|---|

| Permanence | Permanent cessation of account activity | Temporary restriction of account access | No impact on account existence | Merging multiple accounts into one |

| Fees | Potentially applicable closure fees | Typically no fees, or minimal fees | Possible transfer fees | Potential fees for consolidation services |

| Account Access | No further access | Limited access during suspension period | Access to funds in another account | Access to combined funds in consolidated account |

| Complexity | Simplest process, usually | Relatively straightforward | Moderately complex, involving details | Potentially complex, depending on the number of accounts |

| Administrative Effort | Minimum administrative effort for the customer | Minimal administrative effort | Moderate administrative effort | Higher administrative effort for customer |

Account Closure FAQs

Frequently asked questions regarding account closure procedures are addressed comprehensively below. Understanding these common queries and their solutions can streamline the account closure process and minimize potential complications. Accurate and complete information is essential for a smooth and efficient closure.

Common Account Closure Queries

This section details frequently asked questions concerning the account closure process. Accurate and prompt responses to these questions are vital for maintaining customer satisfaction and minimizing potential issues.

- What documentation is required for account closure? The necessary documentation for account closure varies based on the institution and the type of account. Typically, these documents include account statements, proof of identity (e.g., government-issued ID), and supporting documents if applicable, such as a letter of intent or closure instructions. The specific requirements are Artikeld in the institution’s account closure policy. Failure to provide required documentation may delay or prevent the account closure process.

- What is the timeline for account closure? Account closure timelines depend on the institution and the specific circumstances. The institution’s account closure policy should clearly specify the processing time. Factors such as the complexity of the account, required documentation, and any outstanding balances can influence the timeline. Typical timelines range from a few business days to several weeks.

- Can I close my account remotely? Remote account closure options are increasingly available. Many financial institutions offer online portals or secure phone systems for account closure requests. This can save time and effort for customers. However, the institution’s specific policies govern the feasibility of remote closure. Customers should verify the institution’s capabilities for remote account closure.

- What happens to my funds after account closure? The disposition of funds after account closure is determined by the institution’s policies. If there are no outstanding balances or pending transactions, the funds are typically transferred to the designated account or method specified by the customer. If there are outstanding debts, the funds will be used to settle those debts.

- What are the fees associated with account closure? Account closure fees can vary based on the institution and the type of account. Some institutions may impose fees for account closure, especially if there are outstanding balances or if the closure is expedited. Review the institution’s account closure policy for a precise understanding of any applicable fees.

Account Closure Procedure Examples

Illustrative examples of account closure procedures are provided below to clarify the process further. These examples highlight the typical steps and considerations involved in closing various account types.

| Account Type | Typical Procedure | Potential Considerations |

|---|---|---|

| Checking Account | Account closure request, verification of identity, and transfer of remaining funds. | Any outstanding checks or pending transactions need to be addressed. |

| Savings Account | Account closure request, verification of identity, and transfer of remaining funds to a designated account or method. | Possible penalties for early withdrawal of savings if the account is associated with a savings plan. |

| Credit Card Account | Account closure request, payment of outstanding balance, and return of the card if applicable. | Potential late payment fees or penalties if the outstanding balance isn’t paid before closure. |

Specific Situations and Considerations

The following points highlight situations that might influence the account closure process. Careful consideration of these circumstances can ensure a smooth and efficient closure.

- Outstanding Balances: Outstanding balances must be settled before account closure. The institution’s policies may require payment of any outstanding debts or penalties. The institution’s policy should specify the steps to address outstanding balances.

- Joint Accounts: Account closure procedures for joint accounts require the consent of all account holders. All parties must agree to the closure, and the institution’s policy must be adhered to. Joint account closures may require specific documentation.

- Legal Holds or Liens: Any legal holds or liens on the account must be resolved before closure. The institution may need to consult with legal authorities to address these situations.

Closing Summary

In conclusion, closing a bank account can be a straightforward process if you understand the steps and requirements. This guide provides a clear path, from understanding account closure procedures to drafting a sample letter and addressing specific situations. We’ve covered legal and regulatory considerations, as well as alternatives to closing, empowering you to make informed decisions about your account.

Remember to carefully review all instructions and consult with your bank if needed.

Question & Answer Hub

What documents are typically required for closing a bank account?

The specific documents vary by bank and situation, but generally include your account statements, proof of identification (like a driver’s license or passport), and potentially a closure request form. Check with your bank for the most up-to-date requirements.

What if I have outstanding transactions or balances?

You must resolve any outstanding balances before the account can be closed. Contact your bank to understand the procedures for clearing these balances.

Can I freeze my account instead of closing it?

Yes, some banks allow you to temporarily freeze your account. Check with your bank to explore this option and associated procedures.

What are the legal requirements for closing an account in my country?

Legal requirements vary by country. Always check with your local authorities and bank for specific regulations.